The Japanese central bank (BoJ) left its expansionary monetary policy unchanged in its statement. What matters more is the message that BoJ Governor Haruhiko Kuroda delivered at the press conference. Many observers had expected first hints that the ultra-expansionary monetary policy might come to an end, e.g. that the yield target for JBGs may be raised. This speculation was caused by a speech of Kuroda, in which he also referred to the negative effects of ultra-expansionary monetary policy and in which the top Japanese central banker designs a scenario in which low-interest rates can be counterproductive for the inflation target.

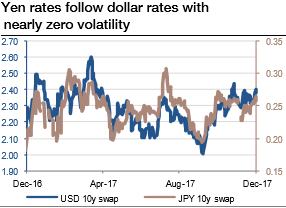

Since the BoJ succeeded in killing yen volatility, USDJPY has been a proxy of dollar rates. Japanese long-term rates are following US rates, but have shown almost zero volatility for a year now (refer above graph).

USDJPY is thus coincidentally positively correlated with JPY rates. This positive relationship actually started in 2015, when the market began to challenge BoJ monetary policy more seriously (refer above graph).

But this has not always been the case, and prior to that, USDJPY tended to come under pressure when JPY rates moved up.

As long as the Japanese rates market is dormant due to the BoJ commitment to monetary easing, the currency will likely stay driven by the dollar leg. But we think that won’t be the case forever: at some point, the yen leg will come out of hibernation.

Buy USDJPY 1y put spread strikes 106/103, global knock-in 116 Indicative offer: 0.33% (vanilla: 0.75%, spot ref: 113.502)

Trade risks: no activation. Investors trading a put spread with a global knock-in cannot lose more than the premium initially paid. However, the structure will be activated only if USDJPY hits the 116 knock-in. Otherwise, it will expire worthless even if USDJPY trades below 106 one year ahead.

Currency Strength Index: FxWirePro's hourly USD spot index is flashing 56 (which is bullish), while hourly JPY spot index was at -164 (which is bearish) while articulating (at 08:52 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025