Euro has collapsed from the peaks of May 2014 (almost more than 23%) but still there is no trace of recovery despite all attempts by euro area leaders.

RSI (14) on weekly chart converging with falling prices (Currently, RSI trending at 39.9357). This momentum indicator has started evaluating when the prices touched 1.1180 by taking the computation of last 14 weeks periods the magnitude of recent gains to recent losses in an attempt to signifying the overbought pressures.

While %D crossover has been maintained on slow stochastic curve with every price dips (Currently, %D line at 55.8150, while %K line at 38.1234). Stochastic on monthly curve also remains in the oversold territory but %D crossover signifies weakness in the euro.

Put Ratio Back Spread: EUR/USD

With this technical reasoning, we recommend arresting further downside risks of this pair by hedging through Put Ratio back Spread.

Expect the underlying currencies EURUSD in this case to make a large move on the downside.

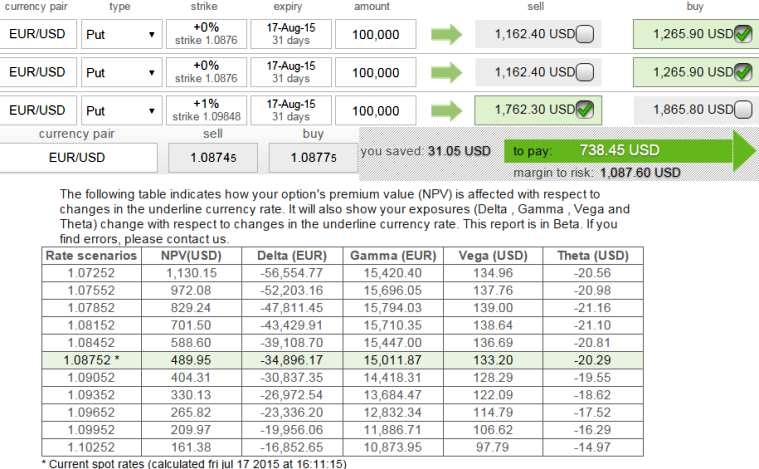

As shown in the figure purchase 1M 2 lots of At-The-Money -0.48 delta puts and sell 1M one lot of (1%) In-The-Money put option usually in the ratio of 2:1 or 3:2.

The short ITM puts funds to the purchase of the greater number of long puts and the position is entered for no cost or a net credit. The delta of combined positions should be around -0.34 with slightly negative theta value.

If a disciplined hedger strictly follows all these mathematical computations, then irrespective of market sentiments, one can be rest assured with the riskfree exposures in his foreign trade.

The underlying exchange rate has to make substantial move on the downside for the gains in long puts to overcome the losses in the short puts as the maximum loss is at the long strike.

Remember to give in a longer time to maturity so as to make a substantial move on the downside.

FxWirePro: Leading oscillators indicate further EUR/USD slumps to persist; PRBS to rescue FX exposure

Friday, July 17, 2015 10:48 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand