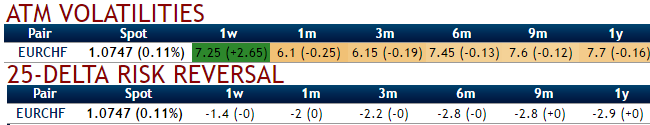

Please be informed that the 1w implied volatilities of EURCHF ATM contracts are rising above 7.25% but have still been the least among G10 currency segment across all expiries.

While the negative 25-delta risk of reversal of EURCHF has also been indicating the mounting bearish risk sentiments, which means the puts have been relatively costlier. As a result, any exorbitantly priced put options could be written off in any optimized costing of the option strategy.

Option trade recommendations:

Well, as we all know that the EURCHF’s range bound pattern is still persisting but some bearish candles are indicating slight weakness on both weekly and monthly charts, (Ranging between upper strikes 1.1110 and lower strikes at around 1.0725 levels).

But as we recently stated in our technical write up, the bulls gaining traction for more upswings so that one could still foresee range bounded trend to persist in future but little weakness on weekly charts is also puzzling this pair to drag mild southward targets but very much within above stated range.

Hence, amid the low volatility circumstance we reckon that the short put butterfly is the most suitable that keeps a neutral stance on underlying spot FX.

The execution: Go long in 1m ATM -0.49 delta puts, while shorting 1w (1.5%) ITM Put and short one more (1.5%) OTM Put of the same expiry.

The strategy expects bullish on volatility while fetching limited returns and carry limited risk.

Risk/reward profile:

Maximum returns are attained for this position as long as the underlying spot FX rallies pass the higher strike price or drops below the lower strike price at expiration.

If the EURCHF spot ends up at the higher striking price, all the put options expire worthless and the trader keeps the initial credit taken while initiating the trades.

On the contrary, the EURCHF at expiry is equal to the lower strike, the lower striking put option expires worthless while the "returns" of the remaining long put is canceled out by the "loss" incurred from shorting the higher strike put. So the maximum return is still only the initial credit taken.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand