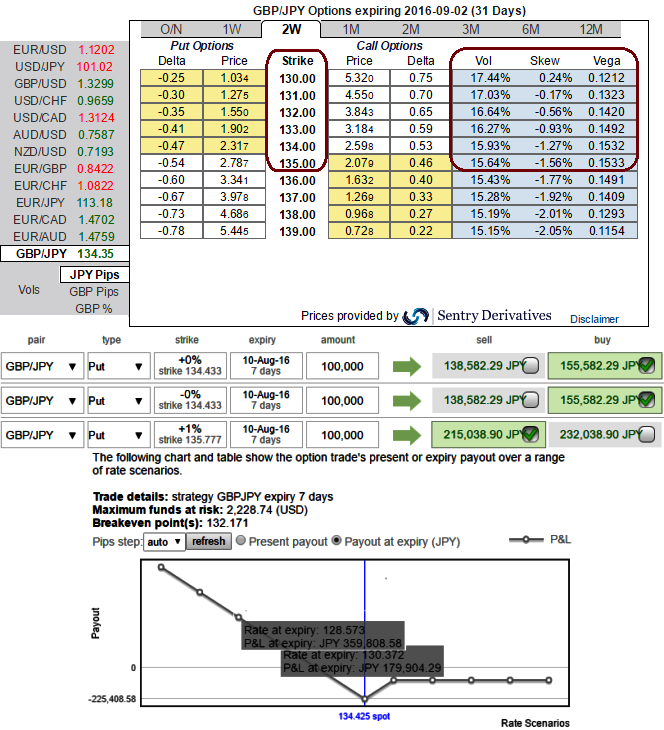

1W and 2W ATM IVs of GBP crosses are acting crazily in OTC markets, GBPJPY flashing more than 19.80% and 17.20% respectively ahead of Bank of England's monetary policy which is most likely to ease about 25bps.

Please have a glance on how implied volatilities skews of ATM puts of 1w and 2W are positively correlated to the OTM strikes.

BoE on tomorrow will be the key, with the inflation report seeing expected effects from Brexit on the real economy. Markets awaits further stimulus, pricing a 90% chance for a 25bps cut in Bank rate and some looking for more QE. Services PMI (CIPS) will be watched closely today as - Manufacturing PMIs were poor this time.

In spot FX of GBPJPY, technically the pair has again drifted below EMAs and DMAs to the current 134.607 levels, what is weighing on the pound's slumps is that, the expectations on BoE monetary policy changes but the chances for lower interest rates in 2016 has grown up, above all lingering post-Brexit formalities adding an extra pressure on sterling's depreciation.

Hence, we advocate the suitable option strategy to hedge the potential downside risks by using any small bounces through ITM shorts, this would have certainly ensured returns in the form of premiums.

With the below technical reasoning, we think arresting potential downside risks of this pair by hedging through Put Ratio back Spread and accordingly, hedging framework was also suggested earlier, for now, it is reckoned that the underlying currency GBPJPY to make a large move on the downside.

So, stay firm with longs on 2 lots of 1M At-The-Money vega puts that would function effectively in higher IV times, long instruments to generate positive cash flows as underlying spot keeps declining.

By now shorts side of 1 lot of 1W (1%) ITM put option would generate assured returns on any abrupt rallies.

The Vega would be at its maximum when the option is at ATM and declines exponentially as the option moves ITM or OTM owing to every tiny shift in IVs that will make no difference on the likelihood of an option far out-of-the-money expiring ITM. Please be noted that the tenors used in the strategy is just for demonstration purpose only, use accurate expiries as stated above.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data