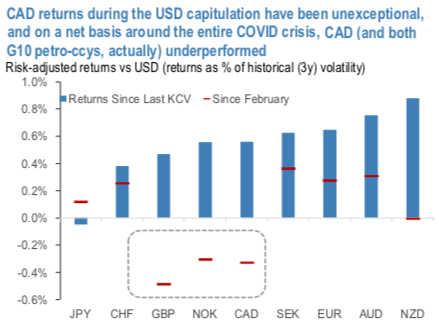

USDCAD has fallen a sizable 4% since our last publication, but this is reflective entirely of the broad dollar’s anti-cyclical properties and negative beta to risk, and is not indicative of outright CAD outperformance. CAD headwinds bias our USDCAD forecasts higher over the medium-term. In some ways, that CAD has only depreciated 2.2% on net against the dollar since March despite the intervening pandemic-led global recession, Saudi-Russo price war, briefly-negative oil prices, and the single greatest Canadian economic & labor market shock ever is remarkable. But this is indicative more of the recent market paradigm shift around risky markets and the USD which has whole-heartedly embraced of the reopening of global economies and the attendant bounce-back in growth, despite the fact that global benchmark oil levels are still 25-30% below pre-crisis levels and US & Canadian unemployment could remain above 10% of the remainder of the year. Indeed, despite USDCAD touching 1.33 and dropping 6.5% total since mid-March, CAD is unexceptional when compared against other G10 currencies this month and, against pre-COVID levels, CAD is actually a relative laggard in G10 (refer above chart).

Thus, despite recent USDCAD weakness, we continue to harbor reservations about the prospects of CAD’s resilience this year, but believe this pessimism is better expressed tactically through crosses than versus the USD as the latter continues to consolidate in the pro-growth environment and as CAD remains well-correlated with riskier assets.

Trading tips: At spot reference: 1.3653 levels (while articulating), one-touch call options strategy is advocated using upper strikes at 1.38 levels. One can see exponential yields as the underlying spot FX keeps spiking towards upper strike on the expiration.

Alternatively, we recommended directional hedges that comprised of longs in USDCAD futures contracts of July’20 delivery, simultaneously, shorts in futures of June’20 delivery. The short leg has delivered desirable hedging objectives so far due to the price dips in the recent past. While long leg of July tenor should be upheld with an objective of arresting potential bullish risks.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes