Two central banks are the prime focus for this week as they are scheduled for their monetary policies, Bank of Canada (BoC) and Reserve Bank of Australia (RBA).

Last month, the BoC formally eliminated its rate hiking bias. This sets the stage for a range of risks – from trade to oil - to feature more prominently this year. The BoC, along with its US counterpart, is now indefinitely on hold.

In completing its dovish turn, the Bank made a number of notable revisions to its outlook to adjust for both serially- underperforming potential growth as well as risks by revising down:

1) the range of neutral interest rate estimates and

2) 2019 real GDP (by a half-point to 1.2%, well below potential at 1.8%).

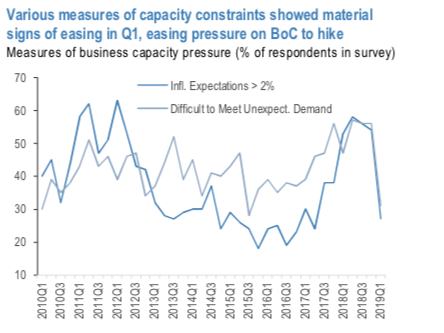

In addition, the MPR noted that excess capacity in the economy has ticked up, and explained that the output gap has expanded even despite a moderation in the overall level of potential growth (refer 1st chart). Taken together, this should eliminate pressure on the BoC to act any time soon, and so with its neutral stance now firmly entrenched, our economists no longer expect any hikes in 2019.

While the Bank of Canada has baked in oil sector weakness into its expectations for this year, an element of policy risk still lingers in the energy sector given recent elections. The election of the business-friendly UCP party in Alberta jeopardizes the current production curtailments as well as the rail transport lease agreement.

It is reckoned that the highest-probability scenario is that both curtailments and the rail plan get scrapped, which would conceivably contribute to an inventory build that once exacerbates transportation bottlenecks and forces a significant price discount (inventories are reportedly already back at peak levels despite the curtailment).

So while crude production might once again pick up and contribute to near-term GDP growth, there will likely be a drag on growth later from inventory build and lower

corporate profitability from depressed prices, which should be a net-negative for CAD until the pipeline bottlenecks are more permanently resolved – something not expected for at least another year.

Accordingly, we maintain our Q2 and Q3 forecasts of 1.35 and 1.36, respectively, to reflect the various risks on the horizon over the coming months.

USDCAD longs were adjusted with stop higher on account of the range-break higher following the BoC’s abandonment of its hiking bias.

3M ATM IVs are trading between 5.27% - 5.70%, positively skews (2nd chart) are also suggesting the odds on OTM call strikes up to 1.37 levels at this juncture. Please notice bullish neutral risk reversals (3rd chart) that signal upside risks in the risk-neutral distribution of returns. Also, the IV curve is at, or slightly decreasing, with maturity.

Favor optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment.

The underlying volatility surrounding USMCA looks set to feature more prominently in the coming weeks and which we feel is biased towards pushing USDCAD higher, leaving us well-positioned with our one-touch USDCAD call option.

Activated longs in USDCAD at 1.3364 at beginning of March. Stopped out at 1.3390 for a profit of 0.31%.

Long a 3m USDCAD 1.40 one-touch calls. Paid 16.70% as part of a calendar spread. Marked at 16.72%. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -59 levels (which is bearish), hourly USD spot index was at -21 (mildly bearish) while articulating at (12:51 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data