Please be noted that the constructive dollar on FED’s recent hiking hints + trade protectionism policies you must’ve seen that the policy hedge in some commodity driven currency such as CADNOK as an oil-neutral trade protectionism/NAFTA renegotiation play and long BRLCOP as a regional Latin RV.

The unpredictability with respect to Trump’s trade policies adds a whole new layer of uncertainties surrounding the MZN, ZAR and the Chinese currency regime in the coming years.

Few signs of trade protectionism stress in MXN, ZAR risk-reversals: We are a quite stunned at how well risk markets and EM currencies have traded despite a slew of trade protectionist-leaning appointments to the Trump cabinet over the past few weeks.

In the 2017 FX outlook, the expectation is that the trade issue to prominently feature in the US policy agenda before long, and Mexico stands in the direct line of fire of the conflict as evinced by this week’s sharp reaction in MXN spot and vols following anti-trade tweets from the President Elect.

Latin America strategists note that Banxico has severely limited reserve firepower to counter a potential regime change in US external policy and that a renegotiation of NAFTA could push USD/MXN levels even upto as high as 25.

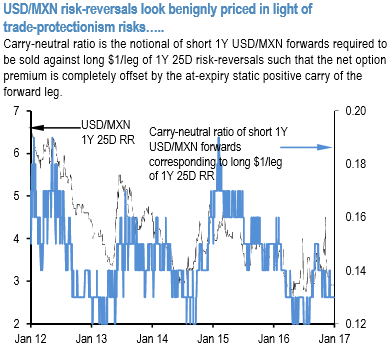

Yet USDMXN risk-reversals look decidedly benign in the light of these risks–1Y skews are back to pre-election levels and near 5-yr tights –and like CNH, particularly in comparison to elevated MXN implied yields that top 7% in 1-yr and out expiries.

One possibility is that depressed riskies are an artifact of USD call/MXN put selling flows from real money yield harvesting programs, but we doubt those will be able to impose a cap on option markets in the event of a shock, and investor positioning in MXN but it does not appear heavily short in a way that can mute realized vol and realized spot-vol correlations in a sell-off.

Along the lines of CNH therefore, partially delta-hedged USDMXN risk-reversals (carry-neutral ratio 0.13) strike us as a more efficient way of carrying short MXN risk than forward outrights. While not as exposed to Mexico trade tensions, USDZAR is another EM currency where risk reversals do not discount much likelihood of EM stress, and a target for establishing short risk positions in anticipation of trade-conflict spilling over onto the broader EM complex.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge