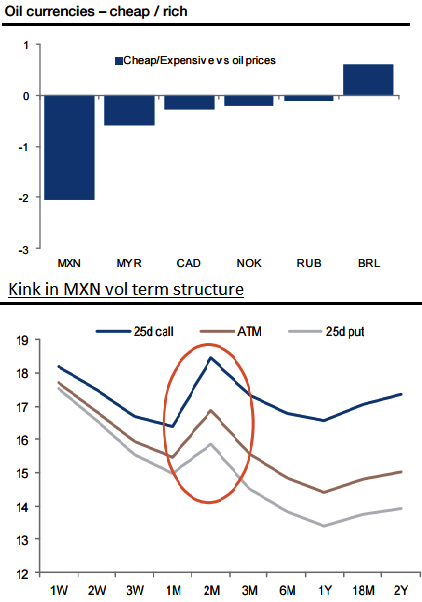

The MXN is around two standard deviations cheap versus oil prices as you can observe in the above chart (based on a weekly regression of FX and oil prices since 2014), while the rest of G10 and EM oil-driven currencies are within 0.5 standard deviations.

The risk premium in the MXN seems related to US politics, and specifically a non-negligible chance that Trump wins in November. Risk premium is not discernible in other currencies or asset classes.

Given the potential sensitivity of the MXN to a Trump victory, the term premium is most noticeable in USD calls. By comparison, the risk premium around the US election is non-existent in other EM currencies.

Selling MXN vol and buying vol in other EM currencies that might come under pressure (KRW, TWD, and TRY) might be worthwhile to consider.

In US election: impact on currency markets we analyse five transmission channels to build an EMFX Trump-vulnerability index.

There is a distinct kink in the MXN vol term structure between the 1m and 3m tenors that straddles the US election (November 8).

EM currencies fear Trump. The ZAR, MXN and MYR have been most sensitive to improvements in Donald Trump’s poll results.

Hence, short AUDMXN to fade US political risk premium and capture MXN being cheap vs. oil and AUD expensive vs. rate differentials (link).

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges