10Y Treasuries yields and US dollar edged lower amid political uncertainties and mixed economic data. On the political front, uncertainty over the capacity of the US administration to implement its policy programme grew. Echoing this, US data were mixed with a disappointing job report, subdued wage growth and soft core inflation print in May. That said, our economists and consensus still expect a 25bp Fed rate hike in June, noting US data would need to deteriorate much more to prevent a hike in June.

While in Europe, The Macron victory at the French presidential elections coupled with better economic data supported risky asset prices in Europe. Inflation, however, remained subdued. Political risks have considerably abated, but others might resurface (uncertainties about the UK general election and the outcome of the Brexit negotiations, the increasing chance of elections in Italy in the autumn). Given these factors, the ECB is expected to leave its monetary policy broadly unchanged at its meeting next Thursday.

Europe-listed ETFs posted $11.3bn creations in May, after $3.7bn in April, almost twice the 3y monthly average of $6bn. Overall, almost all exposures gathered net inflows, in particular IG corporate bonds, EM assets, US government bonds, Eurozone and World equities, all significantly above their long-term average monthly creations. The little redemption came from German and UK equities as well as inflation-linked bond indexations.

EM equities: largest inflows within equity ETFs (+$1.5bn). World: +$1.3bn. Eurozone: significant inflows on large & small caps. US: creations after material outflows in April.

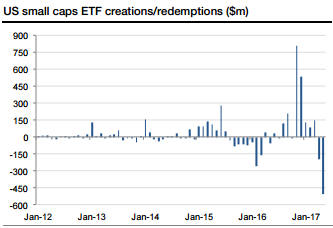

German equities: largest outflows in nine months (- $715m). UK equities: two-year-high outflows (-$345m). US small caps: record outflows (-$507m, see above chart).

EM gov. bonds: continuous inflows (+$1.1bn). US gov. bonds: +$515m, the most in more than one year. European gov. bonds: +$201m after 4 months of outflows.

Gold: $725m creations after a modest $67m inflows in April (see above chart). Silver: +$190m, the highest level in almost 4 years (see above chart). Out of the top 10 monthly inflows, 8 were on gold or silver ETPs. Oil: $78m creations, slightly above the previous month’s level. Industrial metals: +$75m mainly on broad and copper indexations.

Inflation-linked bonds: all-time-high outflows (-$834m), especially on USD indexations (as was the case in April).

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure