Australian Macro Outlook:

The RBA left the cash rate unchanged at 1.5% in the recent monetary policy meeting, as widely expected and forecast continues to maintain status quo in the near future.

The recent data flow has been mixed; retail sales slumped while building approvals bounced.

From last month’s surprise, weakening increases the significance of last week’s labor data which has remained unchanged.

The strong inbound migration to nudge Kiwi retail card sales higher.

Japanese Macro Outlook:

Business sentiment improved from the end of last year but remains cautious.

The PMI rose in March as services strengthened and manufacturing declined.

Wage inflation remained anemic in February.

Inflation expectations have been flat since the BoJ introduced its inflation overshoot commitment.

Option Trade Recommendations:

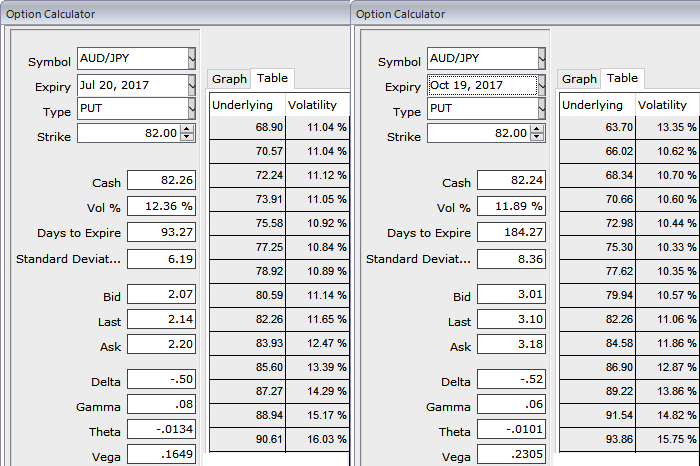

Please be noted that the implied volatilities are spiking in between 11.9% to 12.4% of 3m and 6m tenors of this pair.

Buy 6m 78.0 AUDJPY one-touch put, sell a 3m in premium-rebate notionals.

Buy 3m AUDUSD ATM vs sell 1y AUDJPY 25D Put, 1.5:1 AUD vega.

Buy 4m sell 2m AUDJPY OTM put at 79.0 strike in 1:0.753 notionals.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays