Since we consider the only driving force to the EURJPY's additional upswings is that the temporary relief for Greece debt crisis seemingly offered by euro summit, the overseas traders with huge forex exposures in Euros are advised to hedge their risk with options instruments.

Here is some predetermined trade ideas that we have devised based on potential downside risks to Yen.

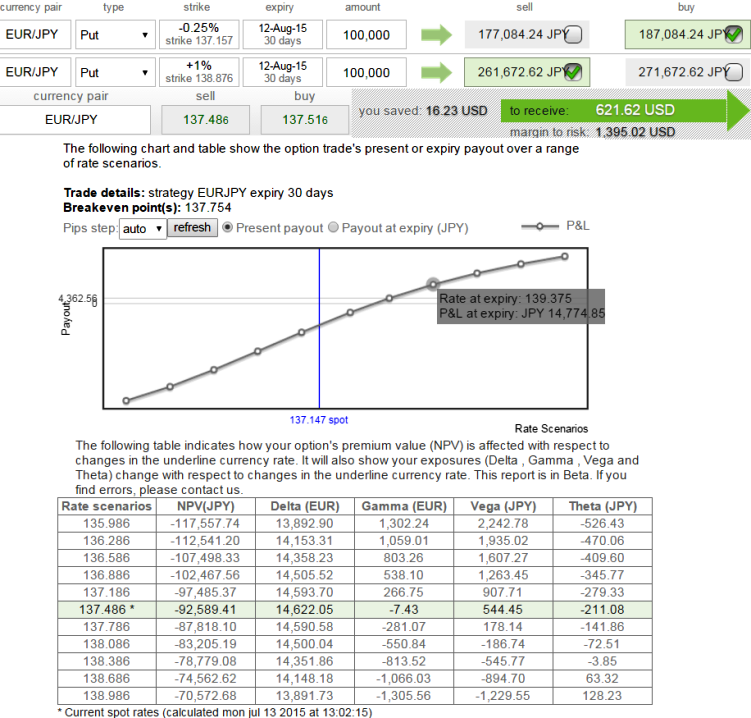

Option strategy: Sell a credit Put spread (Bull put spread)

We can establish this strategy by selling a Put option and purchase another Put at a Lower Strike Price with the same expiration date for net premium receivable.

We recommend purchasing 1M (-0.25%) OTM -0.46 delta put (strike at 137.157) and short one more 1M (+1%) ITM put (strike at 138.876) and the combined position should have 0.14 delta and positive theta or even slightly negative theta is fine with this setup.

This trade strategy is advisable only when the underlying exchange rate is projected to move slightly higher or sideways so that put expires worthless and the entire premium can be pocketed.

Use shorter period for expiration to take advantage of time decay and give lesser time for the stock to move against you.

FxWirePro: Minor gains expected on upswings for EURJPY credit put spreads

Monday, July 13, 2015 7:45 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?