The two main risks to our bearish AUD view are that (1) the currency is dragged higher in a more sustained re-rating of the global growth outlook and that (2) better global news and some signs of housing resilience see the RBA play for time. We remain of the view that the RBA will ease a further 50bp in this cycle. However, if the backdrop for global growth and commodities is favorable.

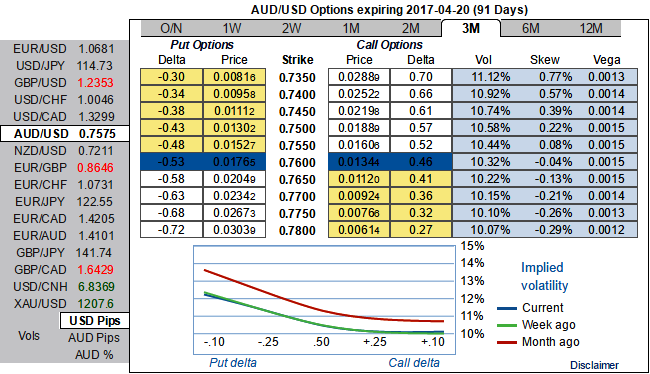

Consequently, OTC indications are AUDUSD's positively skewed IVs and with negative delta risk reversal can be interpreted as an opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

We expect AUDUSD to decline through 2017 on skinnier rate differentials and a pull-back in commodity prices. Our Dec-17 target is 0.68, 7% below forwards. The combination of a more high conviction Fed cycle in 2017 and further RBA easing should see policy rate cross-over occur for the first time since the early 2000s. This will leave minimal carry support for AUD, which is particularly important given its vulnerability to a turn in China’s momentum or adverse developments in global trade.

The iron ore and coal prices have overshot fundamentals by some distance. The surge in Australia’s key commodity exports, particularly in the back half of 2016, caught many analysts by surprise, and has seen nominal GDP growth vault higher.

However, supply disruptions that drove the upswing are now fading in influence. Granted, FX markets had been reluctant to fully embed spot commodity prices in AUD valuations, with AUDUSD trading modestly cheap on our short-term fair value models (Z score of -0.5 on a 6M regression).

But the anticipated commodity decline is meaningful: coking coal prices, for example, have retraced 40% from the November peak, and have another 30% further to fall this year as well, iron ore also is forecast to fall 30% from current levels.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate