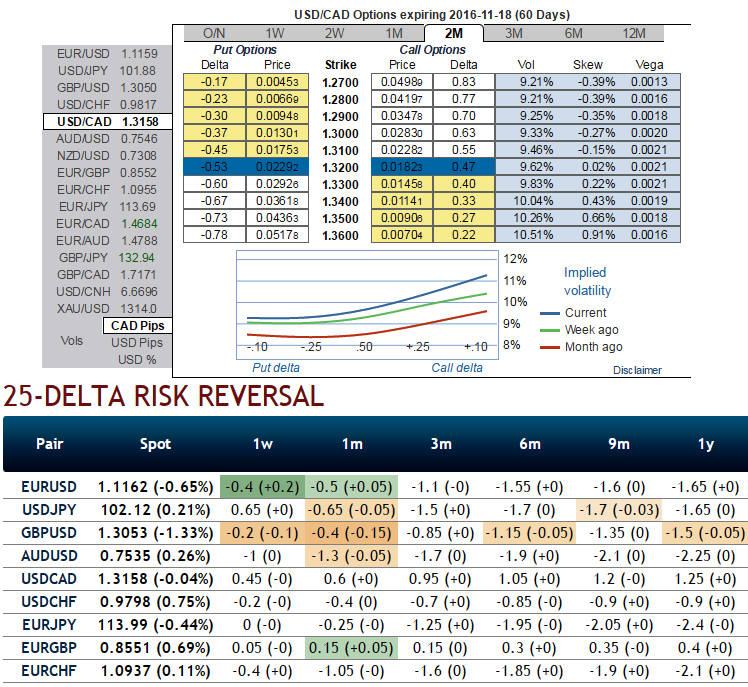

Mounting positive skews in 2m implied volatilities suggests RKO calls, the USD/CAD 2-3m skew has been bid with Trump progresses in the polls, lifting it to its highest level since June 2015.

This increases the implied probability that USDCAD would trade at a higher level so that a topside KO barrier would massively discount the cost of a vanilla call.

From the nutshell showing delta risk reversals of USDCAD, you can probably make out that the pair has been one of the most expensive pairs to be hedged for upside risks as it indicates calls have been relatively costlier over puts which indicate upside risks of spot FX is anticipated and hedging for such risks is relatively more expensive.

We set a KO at 1.40, a level very unlikely to be met in the next two months as the spot visited higher levels only when the oil prices collapsed below $30/bbl in January, a development highly unlikely from the current $45-50 range.

The 2m tenor is appropriate as the option expires in mid-November, capturing the market reaction of the week following the 8 November election, and hedging the immediate reaction to a Trump victory for three times less than the vanilla cost.

The execution: at spot ref: 1.3170, bidding on 3m risk reversals, initiate longs in USDCAD 2m call strike 1.34 knock-out 1.40 Indicative offer: 0.27% (vs 0.93% for the vanilla).

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One