Hush-hush rumors or fact, but the Canadian officials perceive increased likelihood of the NAFTA negotiations waning out, leading the US to leave the trade agreement, dealt CAD and MXN a severe blow last night. While MXN was able to largely retrace its losses following denials from the White House that the President’s position had not changed, CAD is still trading at notably lower levels this morning.

Contemplating this, the Bank of Canada (BoC) rate hike at next week’s meeting less likely as a possible end or even just a curtailment of the NAFA agreement would have far-reaching effects on the Canadian economy. Now that it has become known that the NAFTA negotiations are not on a path towards success at all the BoC might refrain from further rate hikes so as to avoid putting additional pressure on the Canadian companies with higher interest rates and as a result a possibly stronger CAD.

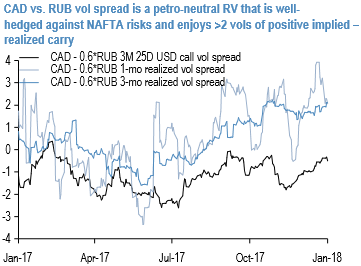

On a related note, we like relative value constructs with CAD or MXN vol as the long leg. One that looks interesting to us at present is a CAD vs. RUB vol spread. The construct appeals because it -

a) is largely neutral to oil price developments, so offers a slightly different risk profile to existing bullish RUB carry positions in the portfolio and

b) enjoys more than 2 pts of ex-anteimplied - realized vol carry (refer above chart), which mitigates to some extent the negative of less-than-stellar entry level on implieds.

The RV edge can be further magnified by deploying OTM USD calls instead of ATMs: USDCAD risk-reversals are materially more depressed than USDRUB even adjusting for base vols (CAD 3M 25D RR 0.4, RR/ATM ratio 0.06; RUB 3M 25D RR 2.6, RR/ATM ratio 0.26) and discount little trade tension anxieties; the additional smile theta of the RUB leg is worth earning in our view in a rising oil price environment when RUB puts are unlikely to be called into play.

We open a 100:65 vega-weighted (~premium neutral) long CAD vs short RUB 3M 35D USD call switch.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis