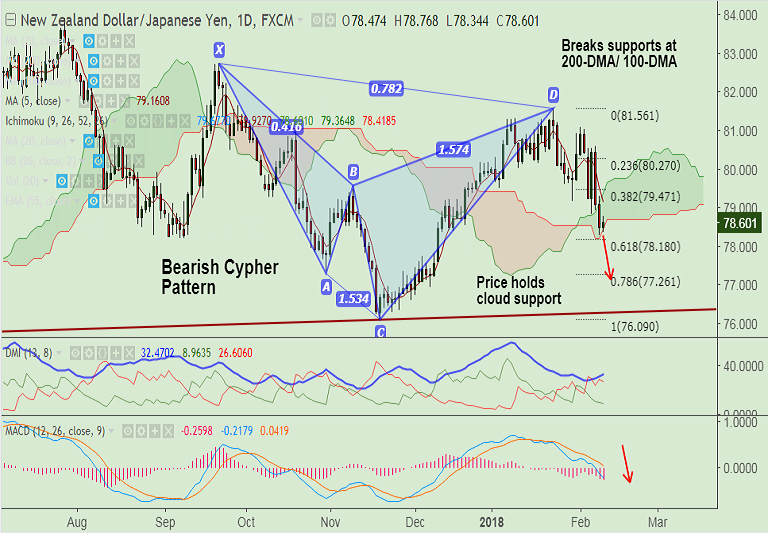

- NZD/JPY extends downside in 'Bearish Cypher' pattern, pauses downside at cloud base.

- Technical indicators are bearish. Break below 61.8% Fib will see further weakness.

- RSI and Stochs are biased lower. MACD supports trend lower.

- NZD/JPY has shown decisive break below major support levels at 100 and 200 DMAs.

- Break below daily cloud finds next support at 61.8% Fib at 78.18 ahead of 77.35 (Oct 31 low).

- On the flipside, decisive close above 200-DMA could see a bearish invalidation.

Support levels - 78.18 (61.8% Fib retrace of 76.090 to 81.561 rally), 77.35 (Oct 31 low), 77.26 (78.6% Fib)

Resistance levels - 79.25 (100-DMA), 79.47 (38.2% Fib), 79.77 (200-DMA)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-NZD-JPY-extends-downside-in-Bearish-Cypher-pattern-eyes-618-Fib-at-7818-1139975) is progressing well.

Recommendation: Hold for targets.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest