Bearish NZDJPY scenarios:

1) The NZ housing market slowdown becomes disorderly

2) The NZ immigration rolls over quickly

3) NZ bank funding issues intensify, causing the market to question NZ's ability to attract capital inflow.

Bullish NZDJPY scenarios:

1) Fiscal easing is delivered quickly

2) New RBNZ Governor Orr starts with a surprisingly hawkish bent.

Over 2018, we see scope for some further under- performance from NZD, as we expect ongoing confirmation that the RBNZ can credibly lag policy normalization in the G3. Evidence that real assets (equities, housing) are threatened by late cycle growth dynamics and government intervention would add further weight to this story.

Markets are now pricing a small chance of an RBNZ easing by early next year. At the June decision RBNZ Governor Orr maintained an evenly balanced outlook for the near-term, with addition of downside risks. The Governor stated the next rate move is equally likely to be up or down, and has placed significant weight on the fact that inflation expectations have become more backward-looking, which slows the recovery from several years of below target outcomes.

NZDJPY’s trend has been within the tight range of 76.859 – 74.040 levels, but the pair is having more bearish traction and expected to depreciate upto 72.5 levels by 3Q’19 as RBNZ outlook remains on hold throughout 2018.

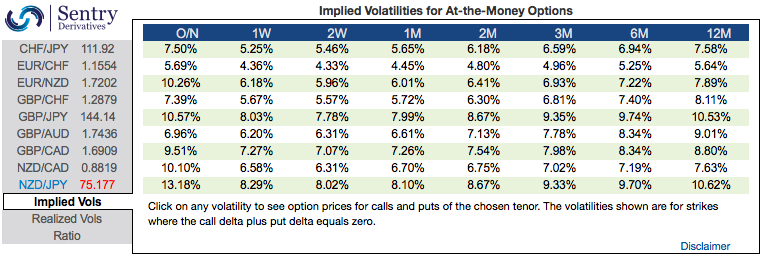

To substantiate this bearish stance, the 2m positively skewed implied volatility indicates the hedging sentiments for the lingering bearish risks. Bids are for OTM puts upto 73 levels.

Implied volatilities of this pair is trending at 8.02% and 8.67% of 2w and 2m tenors respectively. Lower IVs are conducive for options writers and higher IVs are good for option holders.

As a result, we construct suitable options strategy favoring slightly on bearish side. Initiate 2 lots of 2m longs in -0.49 delta put options, simultaneously, short 1 lot of (1%) put options of the narrowed expiry (preferably 2w tenors), the strategy is executed at net debit.

The short side likely to reduce cost of hedging with time decay advantage on short leg, while delta longs likely to arrest potential bearish risks.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 76 levels (which is bullish), while hourly JPY spot index was at 24 (mildly bullish) while articulating (at 06:05 GMT). For more details on the index, please refer below weblink:

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close