Bearish NZDUSD scenarios below 0.67 if:

1) The housing market slowdown becomes disorderly;

2) The immigration rolls over quickly;

3) NZ bank funding issues intensify, causing the market to question NZ's ability to attract capital inflow.

Potential trigger events:

GDT auctions – 5th Jun

RBNZ FSR: 30 May

ANZ business survey (May): 31 May

Terms of trade (1Q): 1 Jun

NZDUSD continues to consolidate in the 0.6850-0.6975 area, utilize this as shorting opportunity.

The medium-term perspectives: The US dollar should strengthen further if the Fed hikes twice more this year, and that will push NZDUSD lower.

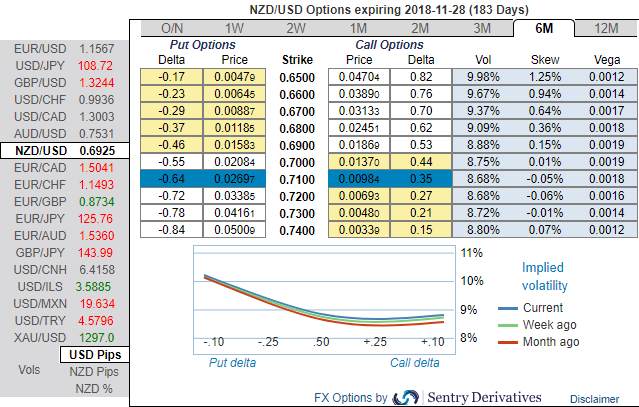

Bids on 3m skews have come in quite worthy, as they signaled the hedging interests for further bearish risks. Thus, we expect NZDUSD to depreciate to USD 0.6650 by end of 3Q’19. Accordingly, we’ve recommended diagonal put ratio back spreads in order to participate both momentary upswings in the consolidation phase and anticipated downside risks.

Writing 1m at the money put with positive theta snaps decisive rallies, you could easily make out short legs on ATM puts would go worthless considering time decay advantage. Simultaneously, we uphold 2 lots of longs in 3m 1% OTM puts, the structure could be constructed at net debit.

It was explicitly stated that “Theta shorts are recommended in this strategy because, Theta is not a constant, it changes as the underlying market moves and time passes. Theta is the sensitivity of an option’s value to the passage of time. It is usually expressed as the change in value per one day’s passage of time.”

Well, for now, the medium term perspectives of this pair seems to be bearish as the US dollar remains in a two-month-old sideways range, which means further sideways ranging in NZDUSD is possible during the month ahead.

Further out, though, we are bearish. The NZ-US interest rate advantage is rapidly shrinking and should eventually weigh, pushing NZDUSD towards 0.68 by mid-year (i.e. 1m skews).

Moreover, the 6m skews are targeting towards OTM put strikes at 0.65 (refer above nutshell) which is in line with the above-mentioned projections.

Hence, on hedging grounds, the option the holder of OTM puts still desirable and is deemed to be on upper hand.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 103 levels (highly bullish), while hourly USD spot index was at shy above 68 (bullish) while articulating at 07:53 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings