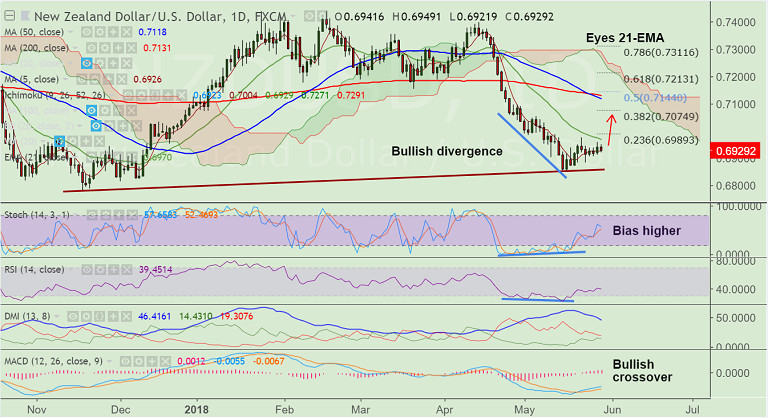

- NZD/USD extends choppy trade below 21-EMA at 0.6970 which is major resistance.

- Technical analysis support a bullish bias. We see bullish divergence on RSI and Stochs which further adds to upside potential.

- RSI and Stochs have rolled over from oversold levels and MACD shows bullish crossover on signal line.

- Markets await New Zealand (NZ) Financial Stability Report (FSR) for the next direction.

- Break above 21-EMA likely to see test of 38.2% Fib at 0.7075.

- On the downside, the pair finds strong trendline support at 0.6850 levels. Break below to see weakness.

Support levels - 0.6926 (5-DMA), 0.69, 0.6850 (trendline)

Resistance levels - 0.6970 (21-EMA), 0.6989 (23.6% Fib), 0.70, 0.7077 (55-EMA)

Recommendation: Good to long on break above 21-EMA (0.6970), SL: 0.6925, TP: 0.70/ 0.7075/ 0.7120

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at 59.7077 (Neutral), while Hourly USD Spot Index was at 65.922 (Neutral) at 0645 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.