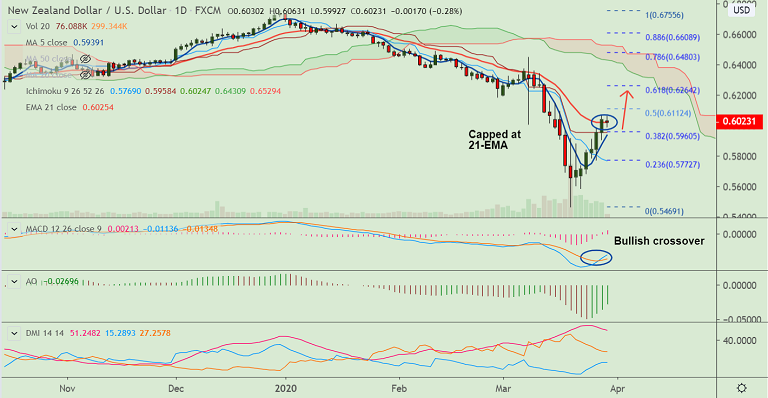

NZD/USD chart - Trading View

NZD/USD trades comatose around 21-EMA resistance, technical bias still supports upside.

The major was trading 0.26% lower at 0.6024 at around 04:00 GMT, with session highs at 0.6063 and lows at 0.5992.

Market’s risk-tone remains under pressure. PBoC's rate cut and the liquidity injection have failed to put a bid under the risk assets.

US dollar is drawing safe-haven bids, while the Kiwi under pressure after RBNZ indicated readiness to take further measures to combat the COVID-19 pandemic.

The Reserve Bank Of New Zealand (RBNZ) said the central bank has other tools on hand to keep cost of borrowing low for as long as needed.

NZD/USD has paused 6-day winning streak. But, technical indicators still support upside. Major trend is bearish, but break above 21-EMA could see more upside momentum.

'Death Cross' (bearish 50-DMA crossover on 200-DMA) to limit upside. Rejection at 21-EMA will see downside resumption.

No major data/events scheduled for the day. Focus remains on the virus/stimulus news for direction.

Major Support Levels - 0.5960 (38.2% Fib), 0.5938 (5-DMA)

Major Resistance Levels - 0.6025 (21-EMA), 0.6112 (50% Fib)

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation