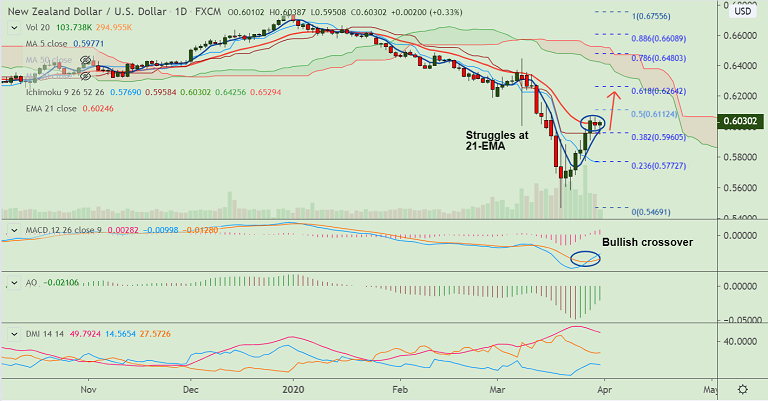

NZD/USD chart - Trading View

NZD/USD has resumed upside after the brief pause on Monday's trade, bias remains bullish.

The major was trading 0.29% higher on the day at 0.6029 at around 06:00 GMT, after closing 0.50% lower in the previous session.

The Kiwi was better bid after Upbeat China PMI which helped NZD/USD recover from the initial mini-flash crash.

Upbeat China data is likely to ease fears regarding a deeper coronavirus-led economic slowdown across the globe.

Risk-tone across markets also remains mildly positive supporting further upside in the pair.

Technical indicators still support upside. Major trend is bearish, but break above 21-EMA could see more upside momentum.

'Death Cross' (bearish 50-DMA crossover on 200-DMA) could limit upside. Rejection at 21-EMA will see downside resumption.

Breakout at 21-EMA will see next immediate hurdle at 0.6112 (50% Fib). Break above eyes 61.8% Fib at 0.6264.

Support levels - 0.5977 (5-DMA), 0.5833 (200H MA)

Resistance levels - 0.6112 (50% Fib), 0.6264 (61.8% Fib)

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios