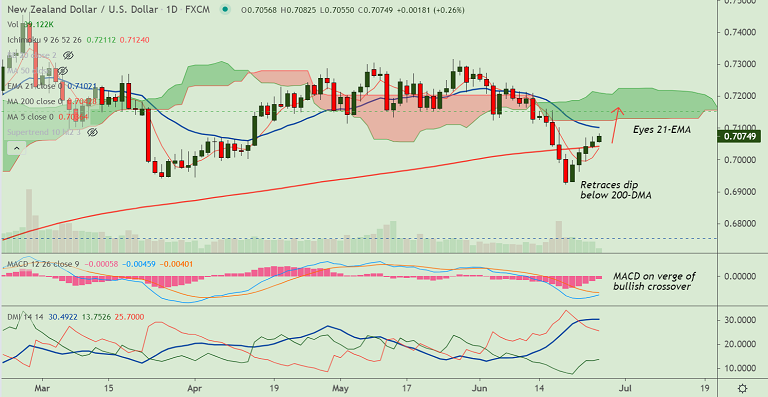

NZD/USD chart - Trading View

- NZD/USD is holding is bullish bias above 200-DMA, trades 0.30% higher on the day at 0.7078 at around 08:40 GMT.

- S&P Global Ratings affirmed China's ratings at A+/A-1 with a stable outlook, in its latest credit review report on the economy on Friday, buoying the antipodeans.

- On the other side, US dollar remains on the defensive amid mixed signals from the Fed officials and weak economic data, pushing the pair higher.

- Data released overnight showed US Weekly Initial Jobless Claims fell to 411K. The reading is well above 200K levels before the coronavirus pandemic.

- The US Goods Trade Deficit widened to $88.1 billion in May, from $85.7 billion in April. While, US Gross Domestic Growth (GDP) remained unchanged at 6.4%.

- NZD/USD is extending its bull run for the 5th straight session. Price action has retraced above 200-DMA and has edged above 200H MA.

- Stochs and RSI confirm a bullish rollover from oversold levels, MACD is on verge of bullish crossover on signal line. GMMA indicator shows bullish bias on the intraday charts.

Summary:

Technical indicators have turned bullish on the intraday charts. The pair is on track to test 21-EMA at 0.7101. Cloud breakout will fuel further gains.

Markets await the US Personal Consumption Expenditure (PCE) Index and Fedspeak to gauge the market sentiment for fresh impulse.