The RBNZ still hints that another rate cut is more likely than not in the coming months after the central bank decides to maintain ‘Status Quo’ in their OCR rates at 2.25%.

But with economic conditions improving recently, the RBNZ shared our assessment that it was worth waiting a bit longer to make that call.

We continue to look forward one more OCR cut this year, at the August Monetary Policy Statement.

On a flip side, Fed’s announcement is scheduled for next week which is likely to remain unchanged as well. This was clearly hinted by recent Yellen’s speech that was quite dovish concerning job market uncertainties and global market turmoil.

So, in light of the signals from the Fed and the recent economic data, we now expect the Fed to raise rates in September, followed by another move in December.

Since we could foresee risk bias on both sides, as the long term downtrend has given trend reversal signal or it is just puzzling.

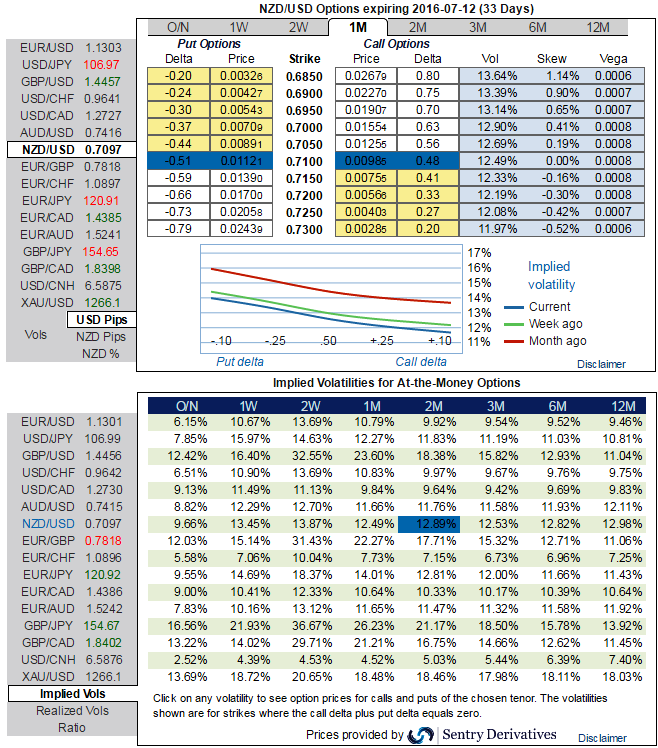

Well, technically although this pair has tested supports minor supports at 0.6679 levels and showing considerable price bounces, bearish pressures at 0.7150 can't be disregarded for short term trend.

On the contrary, a potential breach of 0.7150 would determine short-term rallies also.

Hedging Framework:

The current implied volatility of NZD/USD ATM call options is at 9.66%, lower side IVs are always favourable to the option writers, for long term tenors (1-3m) spiking at 12.5% which is conducive for long term option holders.

Spread ratio: (Long 1: Long 1: Short 1)

With trend puzzling on either direction we like to advocate 3-Way Options straddle versus call option.

How to execute:

Go long in NZD/USD 2M At the money delta put, Go long 4M at the money delta call and simultaneously, Short 1M (1.5%) out of the money put with positive theta.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts