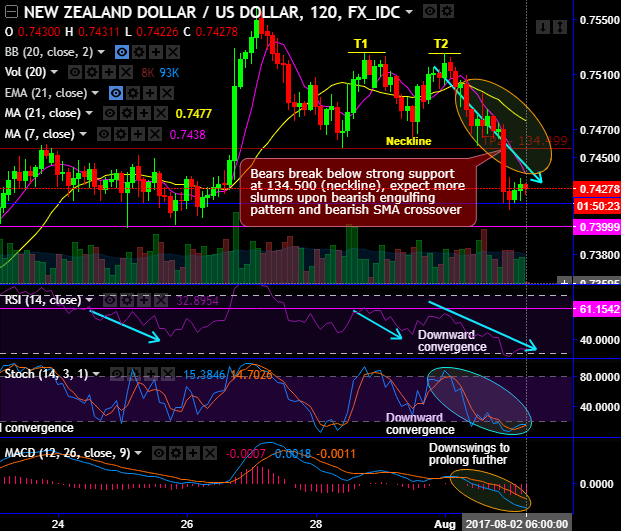

NZDUSD forms bearish engulfing with bearish SMA crossover, the major trend remains intact as bulls are still on 10-months highs.

The pair also forms double top formation with top 1 and top 2 exactly at 0.7525 levels, and neckline at 0.7457 levels.

Bears break below strong support at 134.500 levels (neckline).

On a broader perspective, 3-white soldier candlesticks pattern has completed at 0.7510 levels.

Although there has been the lingering bullish sentiment in major trend, the ongoing rallies may extend rallies but are unlikely to show stern moves above 0.7777 levels as we foresee stiff resistance at this juncture.

For now, any failure swings below 0.7439 levels (7SMA), more slumps are expected upon bearish SMA crossover and clear downward convergence on leading oscillators (on 2H charts).

On the flip side, on monthly terms the bullish swings from last three months are gaining traction upto next stiff resistance levels of 0.74-75 levels on the intensified bullish momentum in the consolidation phase in major trend, bulls extend rallies above EMAs in consolidation phase but again restrained below 0.74-75 resistance levels, uptrend to gain traction upon breach above & decisive EMA crossover.

To substantiate this stance, MACD has signaled the continuity in prevailing rallies but remains in the bearish territory (refer monthly charts).

Well, aggressive intraday speculators can bet on both further upswings upto next stiff resistance levels (maximum upto 0.7439 levels) and thereafter dips seems to be likely upto next strong support 0.7416.

Trade tips:

Contemplating above technical reasoning, at spot reference: 0.7432 levels, keeping 10 pips tolerance level on both sides, the boundary binaries are the best suitable strategy, so use upper strike at 0.7449, lower strike at 0.7406 levels which would mean that the speculative opportunity between 40-45 pips.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -78 levels (which is bearish), while hourly USD spot index was at a tad below -13 (neutral) at the time of articulating (at 06:32 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: