EUR vols do not yet attractive to sell. Some may be tempted to benefit already from the spike in EUR swaption vols triggered by last Tuesday’s Draghi speech in Sintra. EUR vol is up, but from very low levels – so it is still below the highs seen last March.

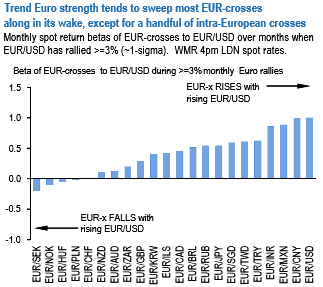

It is worth considering additional expressions of Euro strength after a decent rally in EURUSD spot and vol this week, either by selling Euro-bloc correlates such as USDCHF, USD/Scandies, and USD/CEE, or buying EUR-crosses that have a reliable track record of co-moving with Euro.

It is common market practice to summarize the information of the vanilla options market in the volatility smile table which includes Black-Scholes implied volatilities for different maturities and moneyness levels. The degree of moneyness of an option can be represented by the strike or any linear or non-linear transformation of the strike (forward-moneyness, log-moneyness, delta).

The implied volatility as a function of moneyness for a fixed time to maturity is generally referred to as the smile. The volatility smile is the crucial object in pricing and risk management procedures since it is used to price vanilla, as well as exotic option books.

Market participants entering the FX OTC derivative market are confronted with the fact that the volatility smile is usually not directly observable in the market.

Only a handful of crosses satisfy the latter requirement; EUR/Asia, in particular, are predictable candidates (refer above chart) since idiosyncratic forces in managed, lower beta Asian currencies are often swamped by more powerful global forces during a concerted European surge.

Call spreads are the likely instruments to participate in additional EUR upside after this week’s high-velocity move; using 3M at-expiry digitals as an analytically simpler stand-in, the above chart screens for bullish EUR spread plays within a narrow universe of viable proxies and recommends EURJPY, USDNOK and EURSGD options as better priced than EURUSD to layer on additional leverage.

We have long liked NOK as a valuation play, and there could be RV room for the krone to catch-up to the Euro now that the Norges Bank has removed its long-held rate easing bias and oil has rebounded above $45/bbl.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate