Natural gas price rose last night, trying to build onto Tuesday's comeback, after Monday's mega selloffs, however that effort by the bulls not only got thwarted, price closed in red and in downward move today.

We have been expecting an interim rise in prices from here, however big inventory cushion available just dulled our bullish outlook, as winter remains weak enough. Our stop loss hasn't been hit though, while we expects price to hit $3.1/mmbtu by end of winter season. Failure to which would just bring back out longer term bearish outlook back into focus.

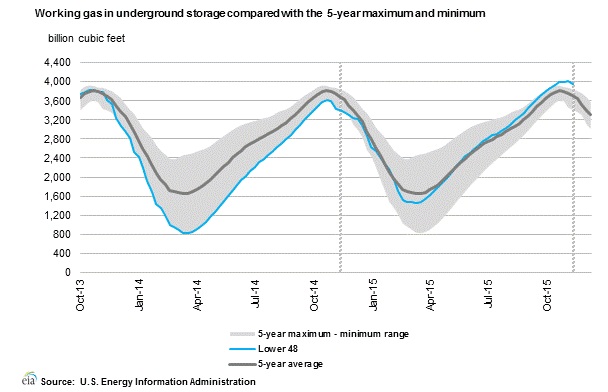

This year, natural gas inventory rose to 4 trillion cubic feet and only last week, first net withdrawal was made of 53 billion cubic feet.

Today at 15:30 GMT, EIA will release this week's natural gas inventory report, which would be crucial. If withdrawal falls below 100 billion cubic feet, downside pressure on gas would remain, whereas lesser withdrawal than last week could lead to sharp selloff, though that scenario is unlikely.

Natural gas is currently trading at $2.05/mmbtu.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX