Norges Bank (NB) left the sight deposit rate unchanged at 0.75%, in a decision widely expected by both markets and analysts.

However, it already sounded a little more cautious by lowering the rate path slightly for the longer term outlook. The rate hike cycle is going to be at a snail’s pace. And even that might grind to a halt more quickly than expected.

According to Norges Bank, a disorderly Brexit entails considerable risks for the Norwegian economy. The lower oil price is also putting pressure on the economic outlook. The probably reasonably short statement today is therefore likely to state that the monetary policy outlook has not changed significantly since the one in December and that the interest rate is likely to be hiked again in March, but will at the same time point out the increased risks. With such a statement Norges Bank is keeping all doors open for the rate decision in March. Until then we will hopefully have more clarity about the Brexit process. If a soft Brexit with reasonably moderate economic consequences is emerging, Norges Bank could still stick to its original plan and implement the next rate hike in March.

Otherwise, it will be quiet easy for it to explain that in view of the risks it is sensible to wait a little longer before taking the next rate step. If Norges Bank communicates this accordingly today the effect on the krone will be limited. Unless it decides already today to call of the March rate hike and communicates that accordingly.

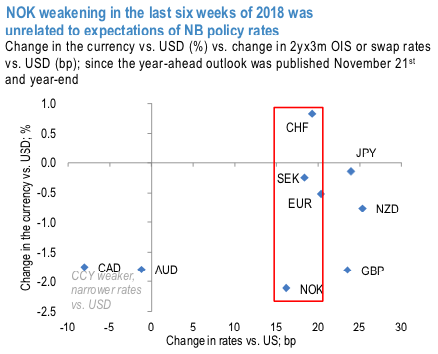

NOK, along with other G10 commodity FX, was among the underperformers in G10 in the last six weeks of 2018. The underperformance of the currency at that time was less related to a rethink on the Norges Bank — Norwegian interest rate differentials have remained relatively robust and NOK nonetheless weakened over this period (refer above chart)but several other factors weighed on the performance of NOK, crude prices declined by 15% since mid-November, risk sentiment as indicated by equity markets has been weak which does not bode well for a high beta FX and in addition, year-end seasonality which typically tends to weigh on NOK performance was at play as well.

However, NOK performance has improved in the New Year and the currency is the second-best performing G10 currency thus far in 2019.

The constructive macro narrative in Norway is unchanged thus far. PMIs have remained elevated and IP beat expectations. 3Q GDP admittedly missed NB forecasts but was impacted by the summer drought and the timelier monthly GDP in October and November was stronger.

Trade tips: We recommend gradually building up NOK exposure in February and find options a suitable tool. Since the beginning of the last week of 2018, we’ve been short EURNOK via 3M seagull and long the NOKSEK spot outright, we wish to uphold these positions. Courtesy: JPM & Commerzbank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -96 levels (which is bearish), while hourly USD spot index was at 16 (neutral) while articulating (at 13:48 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed