Fundamental outlook: Gold prices have tumbled from the highs of peaks of 1295.14 to the recent lows 1215 levels or 6.2% in just three weeks, held near their lowest level in around eight weeks amid growing expectations for a U.S. interest rate hike next month. The metal is highly sensitive to rising U.S. interest rates.

The elections passed largely as expected and US 10 year yields have bounced back after dipping below 2.2% in mid-April, spurring gold to ease of its recent highs around $1,290/oz.

However, we believe the fundamental backdrop remains supportive and that yields have even further to rise on the back of stabilization in US data.

Indeed our baseline forecast calls for the US 10-year yield to reach 2.7% by the end of June, embedding a Fed rate hike at the June FOMC. Given this outlook for higher yields, we recommend entering a short position in gold.

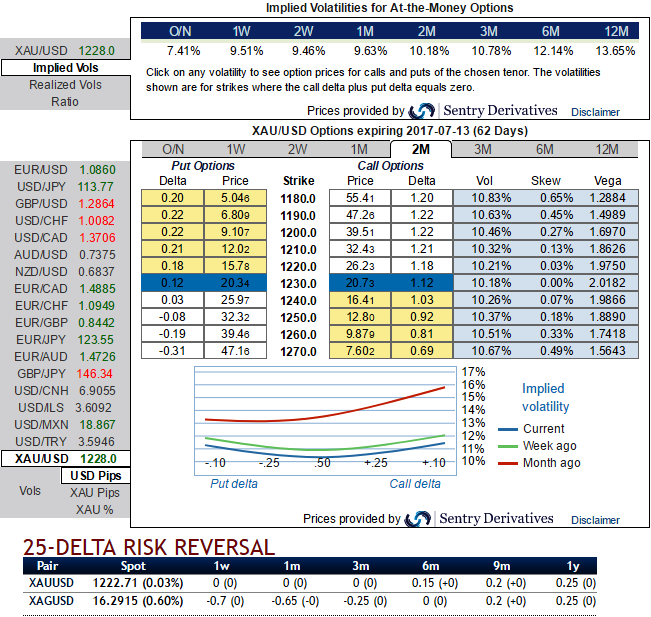

OTC Bullion Outlook and Options Strategy: The above sensitivity tool evidencing delta risk reversals and IV skews evidence gold prices’ momentary edginess and upside risks in long run. Positively skewed IVs of 2m tenors indicates hedgers’ interests in both OTM put and call strikes, while neutral delta risk reversal number indicates topsy-turvy swings in this precious commodity prices.

Contemplating above rationale, we think that the calendar straddle would be more conducive and implemented by shorting a near-term straddle while buying a longer term straddle with an intention to profit from the rapid time decay of the near-term options sold.

Well, it is a limited return with the limited risk strategy entered by the options trader who ponders over that the underlying spot commodity price would experience very little volatility in the near term (please refer above nutshell).

Execution: Stay short in ATM call and ATM put of 1m expiry, while simultaneously buy 6m +0.51 delta call and -0.49 delta put of the similar tenor at net debit.

Maximum loss for the calendar straddle is limited and is likely incurred when the spot price had moved hugely in either direction on the expiration of the near-term straddle.

Maximum gains for the calendar straddle are earned when the gold prices are trading at the strike price of the options sold on the expiration of the near-term straddle. At this price, both the written options expire worthless while the longer term straddle being held will suffer only a small loss due to time decay.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts