Arrest short-medium term downside risks of USDJPY hedging through deploying option strategy: Put Ratio Back Spread

Is the US growth forecast downgrade now complete? We are optimistic that it is and that the drag on the dollar from growth forecast downgrades is behind us. With fed funds futures priced for a 0.9% rate in Q4 16 and a 0.25% rate in Q4 15, we don't envisage much more downward revision to rate expectations. That helps the dollar though won't be a major factor unless or until the US rate forecasts start shifting in the other direction.

Expect the underlying currency cross (USDJPY in this case) to make a reasonable move on the downside in medium terms.

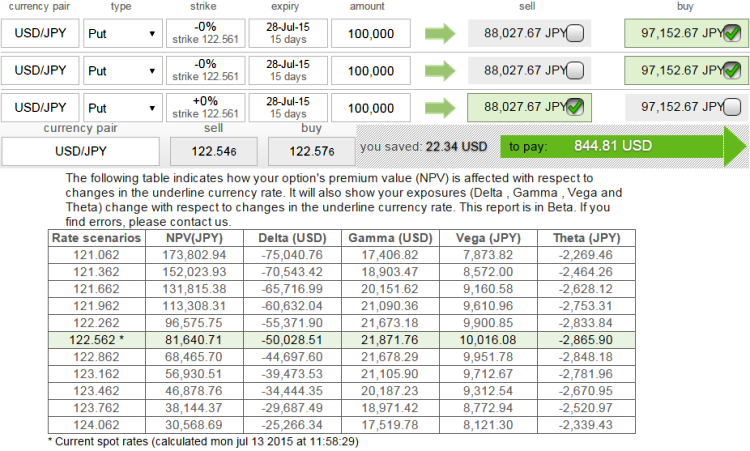

For short term hedgers the recommendation would be; Purchase (1%) OTM puts and sell fewer puts of a higher strike (ATM or ITM) usually in a ratio of 2:1, 3:2 or 3:2.

This is more attractive strategy, basically, as you're selling an at-the-money short put spread in order to help pay for the extra out-of-the-money long put.

The higher strike short puts finances the purchase of the greater number of long puts and the position is entered for no cost or a net credit.

Keep an adequate time for maturity so as to make a substantial move on the downside.

Delta prices and measures options strategy correctly: As shown in the figure it is observed that this strategy offers reliable delta (-50028.51) at prevailing exchange rate which means we are short on USDJPY in underlying market. So, we are participating in Yen as long as it holds its strength but when USD gains appreciation, delta responds proportionately (-25266.34) which means our shorts in underlying have reduced and we are also participating on upswings as well.

FxWirePro: Optimism seen on dollar growth forecasts but delta assures optimal pricing of USDJPY PRBS

Monday, July 13, 2015 6:43 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary