Final Euro zone Manufacturing PMI at 51.7 in August (Flash: 51.8, July Final: 52.0).

French downturn continues and Italy slips into contraction.

Growth in the euro zone manufacturing sector lost momentum in August. Rates of expansion slowed for production, new orders and new export business, resulting in weaker job creation.

The final Markit Eurozone Manufacturing PMI® posted 51.7 in August, a three-month low and down further from June’s year-to-date high.

The PMI has now signalled growth for 38 consecutive months, marking a continuation of its survey-record unbroken sequence above the 50.0 stagnation mark.

While In a report, Eurostat said CPI in euro zone rose by a seasonally adjusted 0.2% this month, compared to forecasts for an increase of 0.3%, and following a final reading of a 0.2% advance in June.

On the flip side, as the manufacturing sector accounts for only around 10% of UK economic activity, the UK’s near-term growth outlook will nevertheless hinge more crucially on developments in the dominant services sector.

The sharp pullback in the Lloyds Business Barometer for August – after a post-referendum drop in June and a rebound in July – bodes less well for a sharp recovery in Monday’s services PMI, notwithstanding the surge in today’s data.

Sterling’s depreciation is likely to be of still less support for the dominant services sector, where Monday’s PMI readings will provide an update. The weaker currency is meanwhile driving up the cost.

Sterling was sharply higher against the euro, with EURGBP down 1.04% at a one-month low of 0.8405.

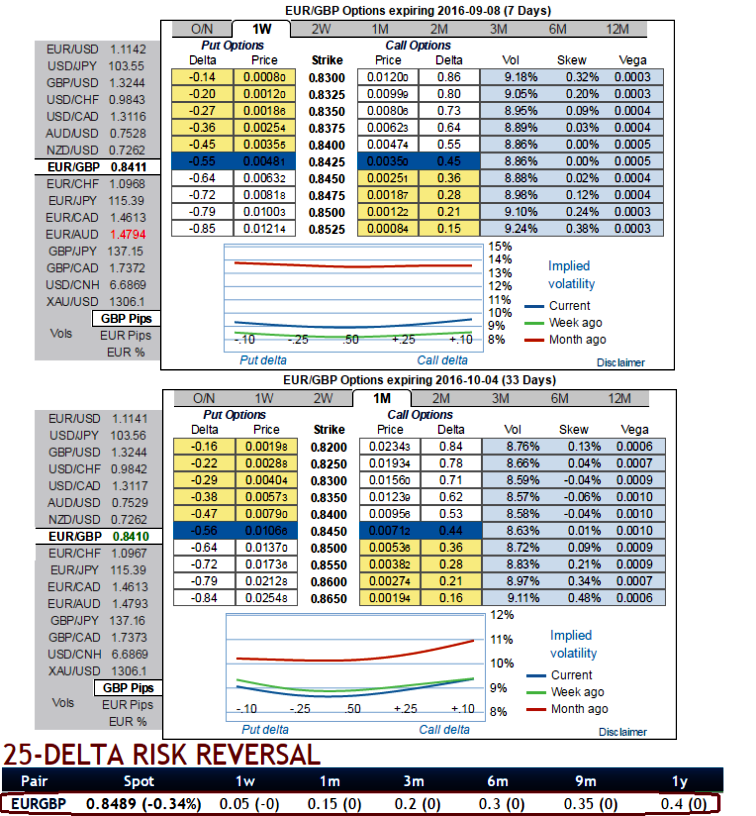

Please be noted that the OTC sentiments for this pair in short run turn towards bears favour as you can make out that the IV skews towards OTM put strikes for 1w tenors and OTM calls strikes for long-term tenors. To substantiate this sentiment, negative changes in hedging arrangements for next 1w expiry and no changes in long-term hedging upside risks. We foresee short-term price drops on the technical side as well while long-term uptrend remains intact so far.

Hence, bidding shorts eyeing on 1w negative risk reversals coupled with longs for upside risks as the 1m IV skews to favour call holders can establish an optimal hedging.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022