The oil markets have transitioned from huge global oversupply, seen in Q2’14 – Q1’16, to a rough balance forecast for the next four quarters, Q3’16 – Q2’17. The next transition, from rough balance to a significant global supply deficit, is expected in Q3’17 – Q4’17.

Driven by falling US supply and healthy global demand, the H2’17 deficit should be bullish for prices next year.

Global demand growth is forecast at a healthy 1.42 Mb/d in 2016 and 1.27 Mb/d in 2017, driven by emerging markets, especially China, India, and other non-OECD Asia.

The US continues to lead non-OPEC supply, as US output of crude is projected to contract by 0.65 Mb/d in 2016, but to decline by a more moderate 0.32 Mb/d in 2017.

We expect shale supply to bottom out in Q2’17 and then hold steady in Q3’17 and Q4’17.

Global inventories are expected to be broadly balanced from Q3’16 to Q2’17. However, in Q3’17 and Q4’17, significant global stock draws of 0.5 Mb/d are forecast, driven by seasonally stronger demand.

From last couple of weeks the crude price has been oscillating between $50-$40 owing to the concerns of demand/supply equation across the globe, today the oil price jumped after an unexpected draw in US crude stocks and an oil service worker strike in Norway. The US crude was up 96 cents, or 2.18%, at $45.01.

American Petroleum Institute data evidenced a draw of 7.5 million barrels in U.S. crude to 507.2 million, while EIA’s (Energy Information Administration) figures are due out shortly.

Hedging Strategy:

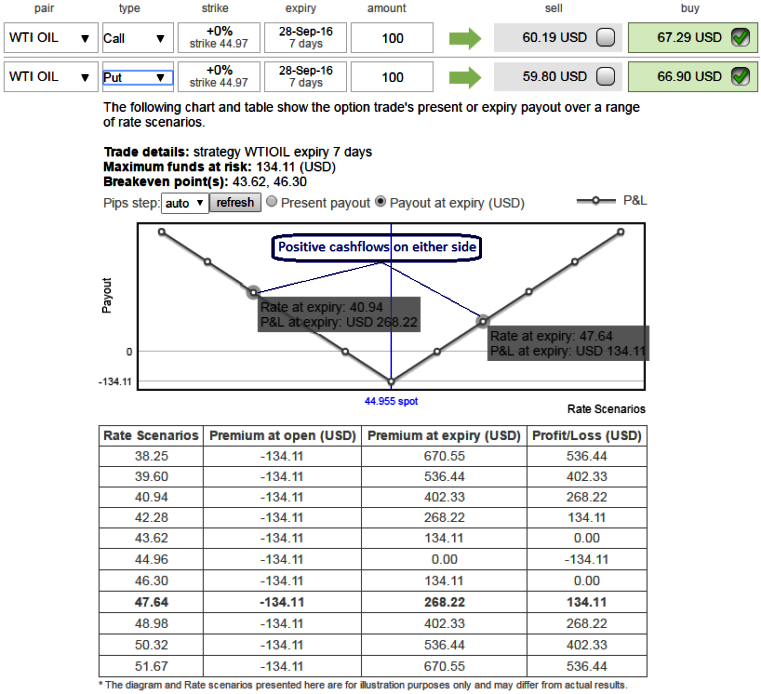

Deploy straddles using At-The-Money calls and puts in this dubious situation.

We are still dubious about WTI crude’s long-term uptrend but because of bullish sensation backed by the speculation from oil minors in supply glut, we also foresee trend seems to be non-directional which is evident in this pair on weekly charts.

Since it should not damage the crude traders we like to remain in safe zone and hence, the recommendation would be buying an ATM straddle as shown in the diagram using at the money +0.51 delta calls and simultaneously at the money -0.49 delta puts of 1w expiries, thereby, one can benefit from certain returns or arrest uncertainties in the price risks even if the pair breaks out on either side in this span of 1 weeks.

The strategy is likely to derive positive cashflows regardless of swings in the underlying commodity prices, which means prices are rightly hedged irrespective price actions.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings