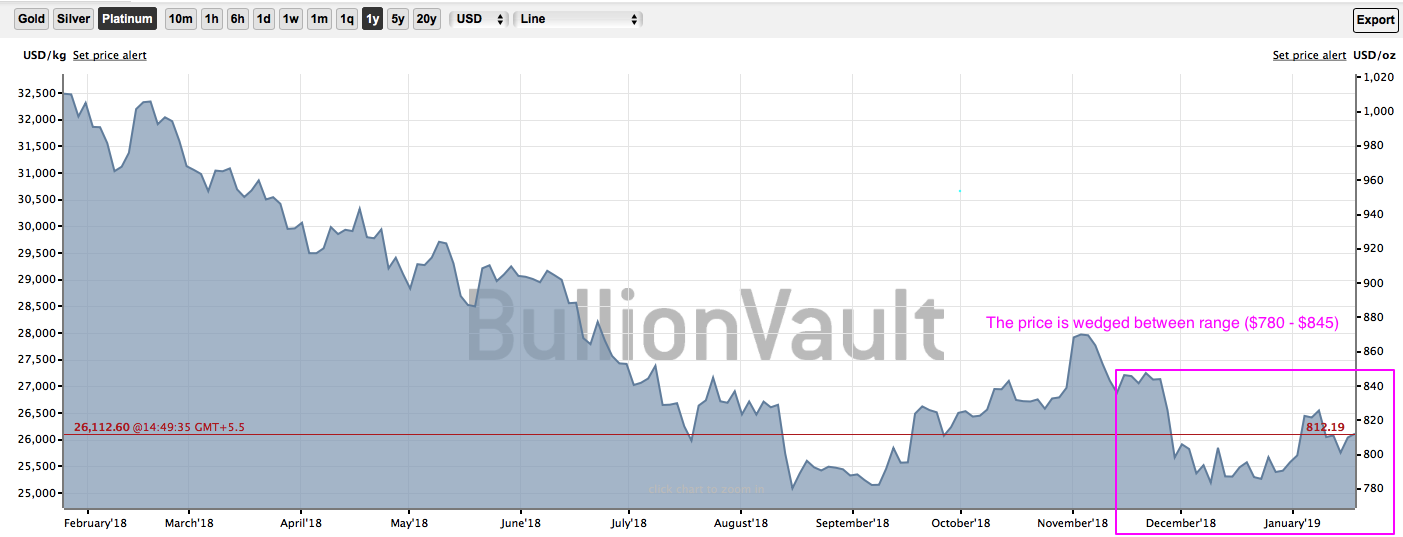

Of late, the platinum price has been oscillating between $780 - $845 range (refer 1stchart). Outside of a one-day 3% up move on January 4 (refer 2ndchart), platinum prices have been extremely stagnant of late and range- bound recently as the metal has largely failed to appreciate in sympathy with gold over the last couple of months.

This hesitancy in platinum is most clearly illustrated by the breakdown in the daily platinum vs gold correlation, which dropped below its recent range in late December and has recently fallen to below +0.4, its lowest level since 2011 (refer 3rdchart).

The divergence between the two metals now means that the discount of platinum relative to gold is flirting with $500/oz (refer 4thchart).

But on the flip side, as explained in our previous post on PGM segment, South African platinum supply has finally begun to slowly rationalize. Yet, just as necessary cuts will likely gain momentum in 2021, we forecast the trend will reverse as new mines ramp up.

As a result, the platinum picks up the torch from here, in our opinion, rallying throughout 2H’19 as the macro picture becomes murkier.

The prices have also trended higher in the last quarter, even slightly outperforming gold, meaning that at current prices around $845/oz, platinum’s discount to gold has dropped back below $400/oz.

The reversal in price trend for both metals is clearly reflected in positioning; however, given the amount of short covering in platinum over the last two months, it’s actually a little surprising we haven’t seen more outperformance.

Outside of futures markets, ETF holdings have largely continued their recent trends uninterrupted with platinum holdings still stagnating around 2.5 million ounces while palladium ETF ounces continue to draw, giving the physical markets some much-desired additional ounces. Courtesy: BullionVault, Bloomberg & JPM

Currency Strength Index: FxWirePro's hourly EUR spot index was at 42 (bullish), USD is at 101 (bullish), at press time 09:42 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts