The European Central Bank (ECB) is scheduled for the monetary policy on July 25th. ECB’s readiness to cut its key rate next week. And there is no reason for the euro to appreciate considerably in the short run.

The currency differentiation and short correlation were laid out as one of the core vol alpha themes for H2 in the Mid-Year Outlook. One class of trades that were identified in there was selling GBP vs. commodity FX correlation on the view that GBP’s idiosyncratic political dynamics would lead to low / no correlation with other cyclically sensitive FX.

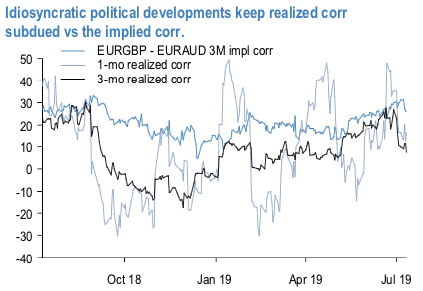

One such corr short that could be considered at current levels is EURGBP vs EURAUD: 3M implied corr is 26% vs. 2-wk realized corr -4%, 1-mo 16% and 3-mo 7% (refer 1stchart). The backtest in chart 2 shows favorable historical performance over the past 3-yrs since the Brexit vote.

A pushback is that if the ECB pivots towards re-starting QE later this year the EUR could fall against everything in sight and lift all EUR-x vs EUR-y realized correlations, as it happened when EURUSD fell from 1.40 to 1.05 during the ECB QE of 2014-16.

Two ways of guarding against this:

a) The limit expiry to pre-September ECB, when a 10bp rate cut is expected and when a potential QE announcement might come; and/or

b) Hold appropriately sized EURUSD put spreads against a short corr. swap, but sizing is a non-trivial problem.

With 2M EURGBP – EURAUD corr swap @24/35 indic we think vol spread is an attractive alternative to consider: 2M GBPAUD – EURGBP vol spread @0.95/1.45 indicative. Courtesy: JPM

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts