Post ECB, clarity from two of the three majors Now that the ECB has confirmed its tapering schedule through September 2018 (a reduction from €60bn per month to €30bn), it is reasonably clear what tedious path DM central bank balance sheets will take over the next two years. In 2018, aggregate balance sheets (Fed, ECB, BoJ, BoE, SNB, Riksbank) will probably expand by about 4%, as a roughly $200bn fall in Fed assets due to maturing Treasuries meets a €270bn ($320bn) increase in ECB assets through tapering and perhaps a ¥40trn ($350bn) increase in BoJ holdings through its yield curve control.

We ponder over the key projections for 2018/19: The smaller influence of QE relative to cyclical factors should only comfort investors who hold two assumptions: that the global growth upturn over the past year has not resulted solely from easy financial conditions; and that G10 inflation will only move slowly towards the target.

Where growth has been levered to low rates – some believe that peripheral Europe can only expand if QE artificially depresses borrowing costs, or that the US economy must be highly rate-sensitive due to record corporate indebtedness – even modest mean reversion higher in yields due to diminishing asset purchases can destabilize economies and markets.

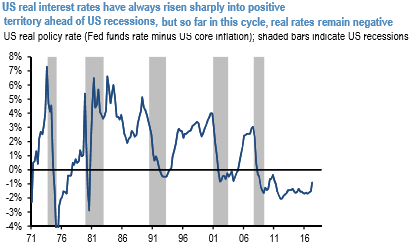

Also, if inflation returns to target more quickly that the Fed, ECB or even the BoJ expect (the author knows it’s hard to imagine Japan with too much inflation), then the positive relationship between inflation and risky market returns will become negative as focus turns to the possibility of restrictive monetary policy, Profits squeeze and a material growth slowdown (refer above chart). We’re still biased to think that these balance sheet preoccupations are fodder for 2019 outlooks rather than the 2018 ones most analysts are crafting now.

For now – and in the wake of ECB decision – better to think more about how much Fed tightening the US money market should price in an environment of improving US growth, normalizing inflation, fiscal stimulus and a new Fed chair. Little of the basic relationship between Fed expectations, the dollar, precious metals, the carry trade and equities has changed, even two years after the first Fed hike.

The significant declines in EURUSD on Thursday and Friday were exclusively caused by USD strength. While the FxWirePro currency strength index for the USD has been slightly bullish by flashing a shy above 67, while EUR has also been highly bearish by flashing -123 while articulating (at 11:57 GMT).

For more details on our index please visit below weblink:

http://www.fxwirepro.com/fxwire/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts