Technicals and Derivatives Insights:

Hedgers should try to avoid exposure to adverse price movements in the underlying currency whereas Speculators has to take position in the market betting on the price movements on either side.

Hedges or arbitrageurs become speculators if risk limits are not defined.

On hedging grounds, we are advocating bear put spreads to arrest downside risks as the major trend seems to be downtrend on weekly charts.

On weekly chart oscillators suggest downward convergence with the falling prices. RSI (14) converges price slumps at 37.3811. While stochastic shows %D line crossover but not significant though yet above 20 levels.

Lots of bearish candlesticks such as spinning top, gravestone doji occurred at 91.388 and 95.288 respectively.

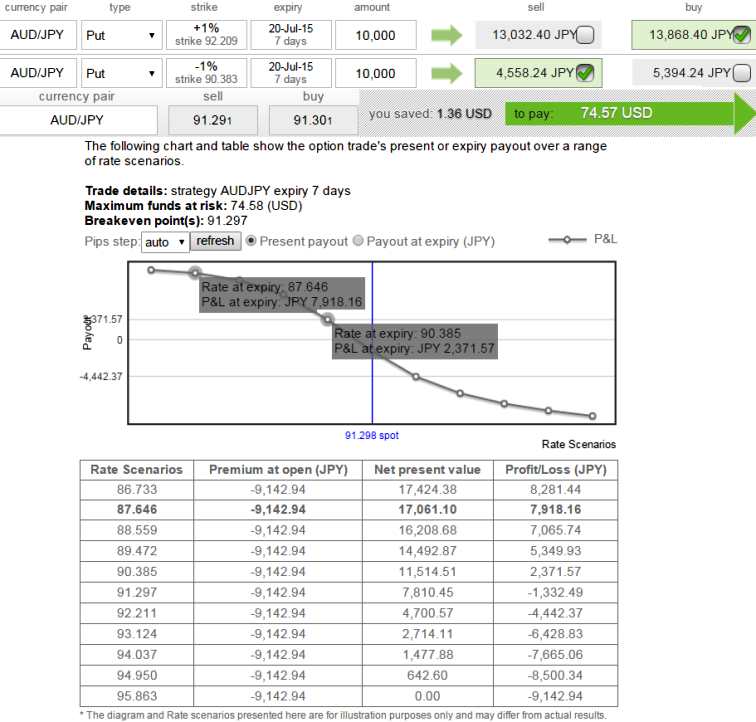

Even though binary calls of this pair looks quite attractive today, on hedging grounds as we are sensing bearish trend on the rallies of AUDJPY currency pair, thus one could get benefited from downswings in near future by taking shorts on futures of this pair. With a trend being bearish bias we still recommend buying 7D (1%) In-The-Money -0.68 delta put option while sell 7D (-1%) Out-Of-The-Money put options for a net debit (something like USD 9309.68 as shown in the diagram).

Bear Put Spread = Protective Put + Sell another Put with lower Strike Price (Out of the Money).

Bear Put Spread reduces the cost of hedge by the premium collected on the Out of the money Put but it comes at the expense of Partial hedge rather than a complete hedge.

The above chart explains how this strategy considering in a scenario evidences the different profitability at different intervals of exchange rates.

FxWirePro: Prefer AUD/JPY put spreads over naked options for hedging

Monday, July 13, 2015 6:05 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand