FxWirePro: Prefer GBP/AUD gamma spreads for hedging and speculating

Thursday, August 6, 2015 7:22 AM UTC

- Overview: Intraday sentiments have been bullish but medium term perspectives demand some corrections.

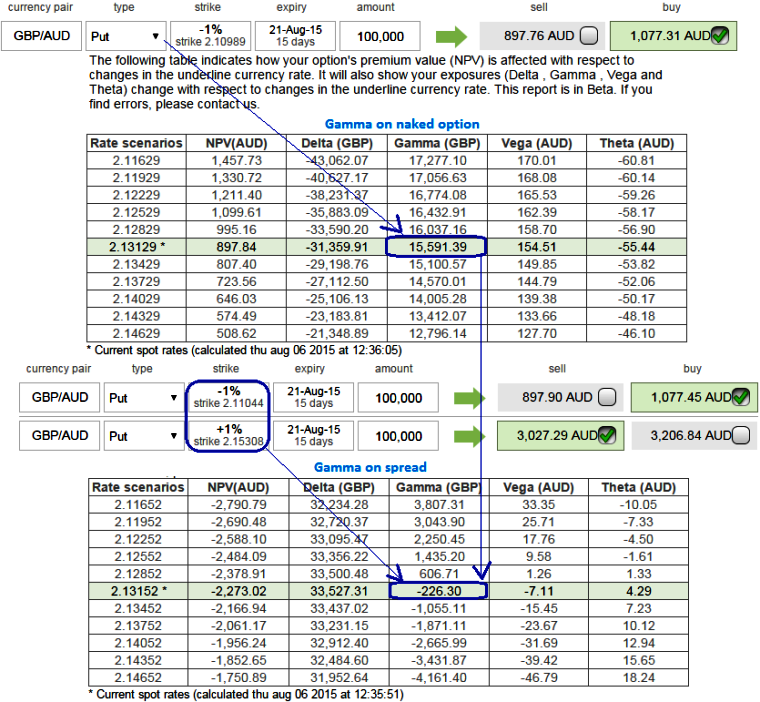

- As you can observe from the diagrammatic representation, we've constructed put spread by considering gamma closer to zero would neutralize the implied volatility impact on option price and this position remains quite firm to achieve our hedging objectives, because we know gamma represents the change in delta, we have healthier delta at 0.33.

- This results in desired hedging objective irrespective implied volatility disruptions as we've ITM shorts and potential bear run will be taken by In-The-Money puts. Note: for demonstrated purpose we've used maturities on both sides as 15 day period but in live scenario ITM shorts should have shorter expiry for time decay advantage.

- While doing so it seems like the FX option of this British/Aussie pair has tons of Gamma factors. A tiny shift in the GBPAUD exchange rate would cause instant disaster. This can be arrested by devoting little time on ascertaining an accurate gamma.

- One conjecture is to buy a short-dated slightly ITM option. You get hold of the option cheaper minimizing the risk and if you are right on the direction, there is a lot of upside as the Gamma increases drastically towards expiry if the option nears ATM or OTM.

- But we recommend on speculation basis buying one touch binary vega calls in order to pull out leverage on extended profits. By employing these binary ATM vega calls one can mint profit unimaginably. But do remember this call is strictly on speculative grounds for target of 15-20 pips.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?