Any currency option deal may be equivalently valued as either a call or a put using a parity condition that is specific to currency options. We considered AUDNZD pair to demonstrate the concept, this condition states that:

Holding a call option to buy 1 unit of NZD for x units of AUD is equal to the holding a put option to sell x units of AUD for 1/x units of NZD.

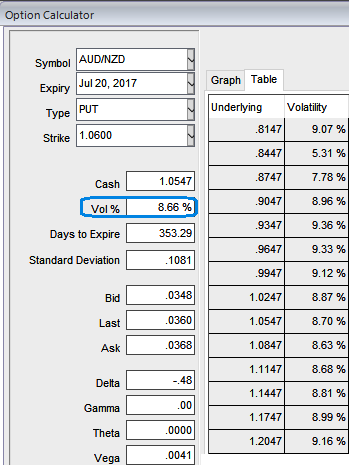

Let’s suppose a foreign trader has purchased NZD (1%) OTM Call / AUD (1%) ITM Put of 1Y expiry in European vanilla style with a face value of AUD $1 million.

The risk-free rate in AUS is +1.44% (3M AUS T-bill),

The risk-free rate in NZ is 2.28% (3M NZ T-bill),

FX rate volatility is at around 8.66%, and let’s say option expiry would be 1 year.

The spot FX is 1.0546 (Direct quote) and the strike rate is 1.06.

Consider AUD as the domestic CCY, so the spot must be quoted as the number of units of NZD required to purchase 1AUD.

To value the option as a call, we treat the AUD as the domestic CCY and the NZD as the foreign CCY. The domestic and foreign interest rates are therefore 1.44% and 2.28%, respectively.

Note that once both the spot and strike quotes are converted, the call option is out of the money.

When these parameters are passed to the Garman-Kohlhagen routine, a value of NZD 0.029181 is returned.

This is a per unit value, and since a total of 1 million Aussie dollars underlie the deal, the total premium value is 0.029181 * 1,000,000 = NZD 29,181(with allowance for rounding).

In order to demonstrate the parity condition, we could also value this deal as a put. In this case, the domestic (foreign) CCY is the AUD (NZD), the domestic (foreign) interest rate is 1.44% (2.28%), the spot rate is 1.0544 and the strike rate is 1.06.

With these inputs, the model returns a value per unit FX of USD 1.0544 and the total value of the premium on the deal is AUD 27,675. This amount is equivalent to the NZD premium computed above when it is converted to NZD at the spot rate of 0.6851.

If the spot FX is expressed in a consistent approach to the strike price, then the computed total premium for the call leg will be the same as the computed total premium for the put leg, assuming both values are expressed in the same currency.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data