FX vol curves, despite the recent retracement, remain still heavily inverted, offering a value in owning fwd vol at a discount vs. spot vol.

Last week, we noted USDMXN and USDRUB as two notable candidates in fwd vol space.

While vol carry (measured as spot fwd vols difference) is traditionally the first metric to measure fwd vols appeal, we also bring into consideration the headroom that fwd vols have if they are to retrace their 15-year high.

Liquidity permitting, the EMEA fwd vols (USDPLN and USDHUF) and USDKRW within Asia EM screen attractively on that measure on the back of so far fairly modest response to the COVID-19 developments (especially within EMEA currency pairs).

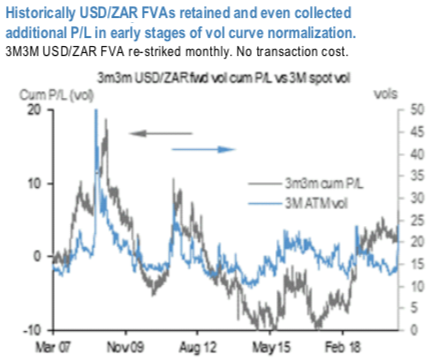

Considering the strong lean toward long gamma from the timing model and favorable fwd vols pricing, we recommend synthetic fwd vols via short 3M / long 6M gamma neutral calendar in USDPLN and USDZAR (refer above chart).

The wide dislocations as observed in the market might also imply an elevated reward for embracing long-risk trades. Possibly, keeping in mind the liquidity issue in vol space as mentioned above, one takeaway from the filtering analysis would be to wait until market conditions stabilize before looking at fading any residual risk premia by then.

The wide dislocations as observed in the market might also imply an elevated reward for embracing long-risk trades. Possibly, keeping in mind the liquidity issue in vol space as mentioned above, one takeaway from the filtering analysis would be to wait until market conditions stabilize before looking at fading any residual risk premia by then.

March). This is particularly the case in the Asian space, where risk-reward for such trades is positively skewed, especially for cases like USDINR, EURINR and EURCNH.

Consider:

On USDZAR, sell a 3M straddle at 18.95 vols choice / buy a 6M straddle at 18.5 vols (1.25 vols from mid).

3M ATMF/ATMS put spread on USDINR at USD 1.5% (off spot reference: 75.3, fwd 77.88).

1y ATMF/ATMS put spread on EURCNH at EUR 1.4% (off spot reference: 7.8365, fwd 7.97). Courtesy: JPM

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays