We are witnessing 4th consecutive days’ rallies in gold’s (XAUUSD) price. Bulls accumulating and currently trading at around $1,499 an ounce (while articulating) upon intensified buying momentum on various driving forces.

The US political developments were catapulted into the driver's seat last week. The vols of precious metals markets spiked back to near the Aug highs but the uptick was short lived which is perhaps unsurprising considering that despite all the noise, the FX vol markets broadly ignored the developments.

We highlighted one-touch gold call calendars last week as a play on long term gold appreciation. With the flip-flopping gold spot, we think that an appeal for the XAUUSD one-touch calendars, which sell short term gold upside in order to finance the longer term upside, is even stronger.

OTC Updates:

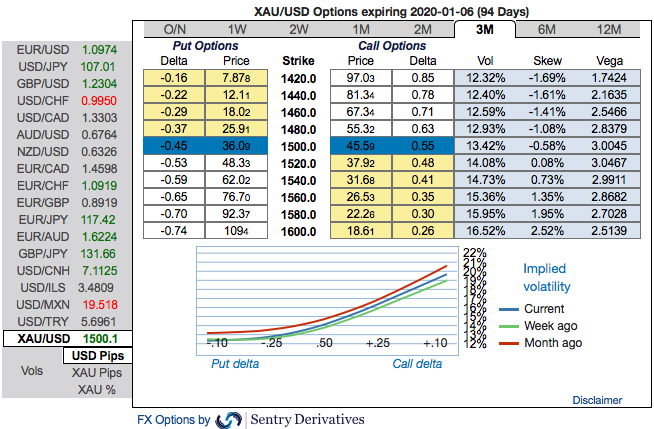

Please be noted that the positively skewed IVs of 3m XAUUSD contracts are still indicating the upside risks. One could also observe the bullish risk reversal setup. To substantiate the above-mentioned dubious bullish sentiment, risk reversal (RRs) numbers indicate overall bullish environment.

The above risk reversal numbers have been known as a gauge of gold’s underlying market for bullish opportunities. Contemplating above OTC hedging outlook, we reckon that options are predominantly meant for hedging a probable risk event in future.

Options Trade Recommendations:

Short 2M 1,570 strike XAUUSD call one-touch vs. long 4M 1,570 strike call one-touch is priced @12/18%USD (mids) and 2m static carry of 23%, which seems attractive to us as longer term defensive stance that utilizes the 1500 sticky level. The template of narrow USD weakness against safe haven assets in the event of re-emergence of Washington risk premium in the dollar is unlikely to apply to cyclical commodity FX, and their correlation to gold is likely to weaken further.

This opens up opportunities to exploit the correlation setup to structure high leverage gold- based anti-risk dual digitals that cheapen the gold topside view by >50%.

Consider 4M (XAUUSD > 1570 (5% OTM), AUDUSD < 0.67 (1% OTM)) dual digital @5.25/11.25%USD, spot ref 1496 for gold and 0.676 for AUD.

Alternatively, capitalizing on any abrupt dips in the gold price in the short-run and OTC indications, bullish neutral risk reversals of gold, we advocate longs in gold via ITM call options as they look to be the best suitable at this juncture.

Buy 3m XAUUSD (1%) ITM -0.69 delta calls on hedging grounds. If expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying. Courtesy: Sentrix, JPM, and Saxobank

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed