Is this the right time for even a partial rollback of our coronavirus lockdowns and resume our respective businesses? The prevailing pandemic doesn’t seem to allow that, the total reported death cases exceeds 1.4 million due to the deadly contagious coronavirus, almost all markets have halted with a trauma.

But, China’s Wuhan megalopolis, the outbreak’s first epicentre is finally relaxing its rules after a lockdown that lasted more than two months. As of today, outbound travel is allowed again, at least for those who can show a green QR code on their phone screen that denotes good health.

China's FX reserves declined by USD46bn in March, the biggest drop since December 2016. However, the authorities explained that this is largely due to the valuation effects as stock market crashed in March and dollar strengthened (which would reduce the dollar value of non-dollar reserves). Recent data provided by Chinese foreign exchange regulators suggest that corporates and individuals have turned to net selling dollar positions (i.e. long CNY) in the first two months of 2020.

Nevertheless, it remains questionable whether this trend could sustain. In the FX market, CNY simply ignored the seemingly negative headline reserve data, and rallied against the overall risk-on sentiment, with USDCNY below 7.05 mark.

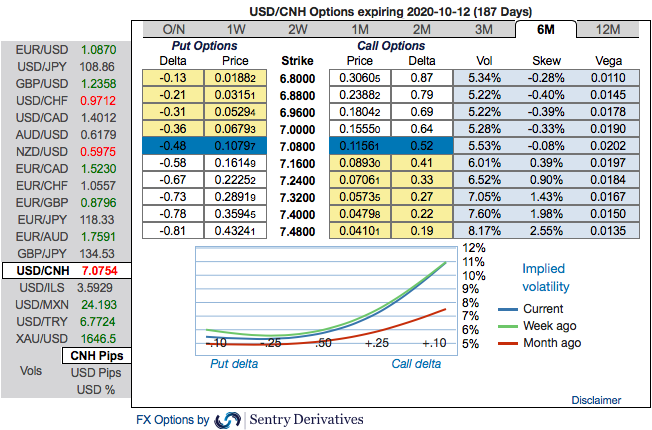

Please be informed that the positively skewed USDCNH IVs of 6m tenors still indicate the upside risks, they are still bids for OTM call strikes up to 7.48 levels.

Hence, at this juncture, we uphold our shorts in CNH on hedging grounds via 6-month (7.00/7.40) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CNH recommendations. Courtesy: Sentry & Commerzbank

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields