Equity markets accelerated the post-Covid shock recovery since mid-May, with the S&P Index trimming the loss from mid-February to 7.5%, on the back of a more market widespread optimism regarding a possibly V-shaped economic recovery. The US dollar fell sharply over the same period, after having been the main beneficiary alongside JPY and Gold safe havens of the risk-off environment.

Furthermore, USD would generally be much less supported than over the past few years from a yield- standpoint (EURUSD moved sharply higher during the first week of March due to carry unwinds) as markets gradually emerge from the peak of the COVID-19 crisis with much lower levels of interest rates, with the Fed having had more room to cut than other major CBs. The EUR remained supported following the ECB decision yesterday to increase the PEPP facility by €600bn, by leaving interest rates unchanged.

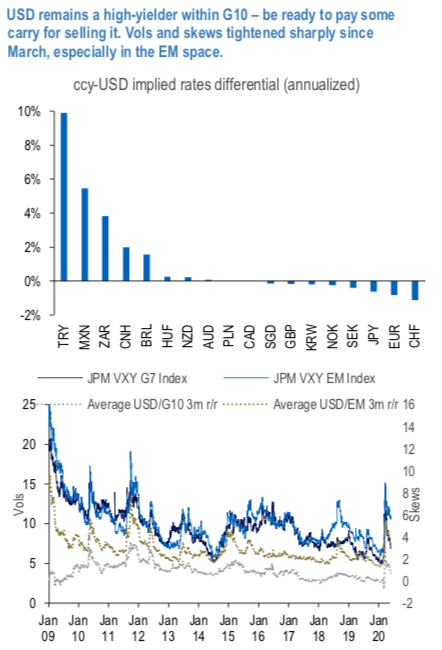

When looking for a possible implementation of the short- USD theme, one needs to be aware of the interplay between pricing parameters and expected PnL under the different scenarios one might be envisaging. In this respect, a first observation is that selling USD is in most cases a negative- carry play within the G10 space (refer top part of 1st chart), which means that forward solutions are going to be associated with a cost unless the move in spot were large enough to compensate for the carry. USD vols and skews (refer bottom part of 1st chart) rose sharply in March as markets went through the most acute phase of the COVID-19 crisis, and receded ever since.

However, the drop in G10 vols and skews has been way faster than for EM currencies, which would necessarily introduce a marked sensitivity across different pairs as far as initial pricing and distribution of expected PnL is concerned.

For instance, an elevated USD skew would imply a better discount for selling the dollar via riskies, whereas forwards would naturally allow to bank on a positive ccy-USD carry. The relative appeal of capped call/put-spreads structures would crucially depend on how big one expects the USD drop is going to be.

Last year, we have introduced a FX hedging scorecard for carrying out systematically the “screening” exercise as described above. In there we focused on forwards plus three low-cost derivatives structures (riskies, call/put-spreads and seagulls) for helping clients to implement directional hedges and looking for the instruments offering the best ex-ante appeal based on pricing. The latest recommendations from the model for going directionally short USD (i.e., long EURUSD, GBPUSD, AUDUSD and NZDUSD and short USD/ccy in all other cases) are reported below (refer top part of 2nd chart). Numbers in the chart should be interpreted as optimal allocations. We note the prevalence of forwards for playing lower USD/EM given the typically positive carry associated with such trades. In the G10 space, allocations to forwards are typically lower, on the back of the negative carry typically involved and the faster drop of volatility levels. Courtesy: JPM

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One