BoJ: On BOJ’s Kuroda speechtoday, FX market seem to be nudging trade war tormentor for a while. There is no sign of raising rates for a quite some time and the recent phases to shift policy more flexible are not targeted at placing the groundwork for an eventual exit from its massive stimulus.

In the recent past, the Bank of Japan (BoJ) confirmed rumors and tweaked by announcing a shift to the range of assets it would buy as form of its yield curve control strategy and introducing extensive "forward guidance" committing to low rates for a prolonged period of time. It would now allow larger volatility of the 10y yield around its 0% target, while it still plans to counteract excessively rapid increases in the yields. However, the market reaction to last week’s media reports probably showed the central bankers that this adjustment left alone would result in an appreciation of the yen.

RBA: Early next morning (before the next Daily Currency Briefing appears) the RBA decides on its key interest rate. A change is not imminent (at least nobody expects this). The weak Australian dollar is no problem for monetary policy there. On the contrary, it is more appropriate, if one may believe what the Central Bank has said.

Interest rate hikes are likely to occur at best late this year or in 2019. With inflation just over 2%, this RBA stance is understandable. In the medium term, however, the RBA sees itself in a dilemma. It regards the high level of private sector debt as an obstacle to a restrictive monetary policy - should this become necessary in the future. That, at least, is the implicit message of their „Corporate Plan“, published on Friday. This does not argue against interest rate hikes, but is a risk for our scenario that they will turn out so unhindered that significant AUD strength can result from them.

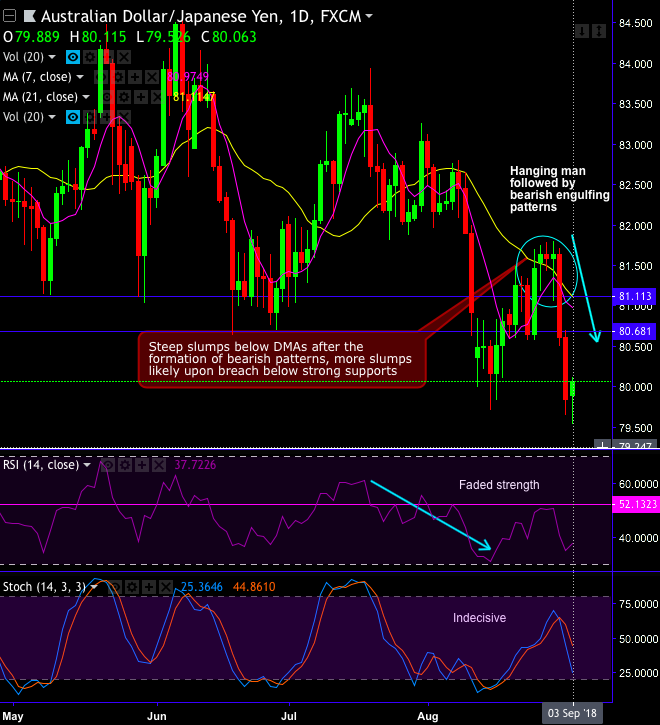

We reiterate AUDJPYforms frequent hanging mans followed by bearish engulfing patterns at 81.636, 81.632 and 80.606 levels respectively.

Ever since then, you can observe steep slumps below DMAs after the formation of these patterns, for now,more slumps seem to be likely upon breach below strong support at 81.113 and 80.681 levels (refer daily chart).

Trade tips: On trading grounds, at spot reference: 80.049 levels, one touch put options are advocated for targets upto 79.500 levels.

Alternatively, on hedging grounds, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards 79.500 levels in the medium run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: Commerzbank

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -36 levels (which is bearish), while hourly JPY spot index was at 30 (mildly bullish) while articulating (at 08:54 GMT). For more details on the index, please refer below weblink:

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields