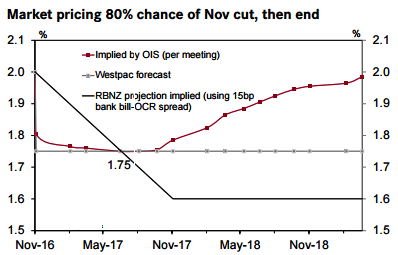

The markets betting odds for a November OCR cut has been very unwavering during in the recent past at probabilities slightly more than 80%. However, the market now reckons any further easing beyond Nov as a zero chance and is now instead pricing in some chance of tightening during the year ahead (see above chart).

We don’t anticipate any such tightening, rather a lengthy period on hold. The RBNZ should signal that on Thursday via its MPS, which will unveil a new OCR projection.

The projection plus its guidance sentence should tell us where it sees the OCR during the year ahead.

The challenge for the RBNZ will be to signal a lengthy pause but not necessarily an end to the easing cycle. If the market concludes the easing cycle is over, it will price in tightening (markets eschew pricing in stability) and push the NZD higher.

NZDUSD has broken higher and retains decent positive momentum, such that a break above 0.7370 (22 Sep high) is looking likely, en-route to 0.7485. NZ fundamentals are supportive, as is the recent slippage in the US dollar. So what could do damage to the NZD this week? In short, the RBNZ or Trump.

We target 0.70, based on an assumption the Fed will hike in Dec and the RBNZ will cut in this week's meeting. However the persistent backdrop of global demand for high-yielding currencies is strong - if the Fed either doesn’t hike or signals very gradual tightening, then 0.75+ is likely instead.

Contemplating all these underlying factors, to arrest these downside risks we advocate initiating longs in 1m (1%) ITM put option with net delta -0.71.

A higher (absolute) Delta value is desirable for an option buyer, whilst a Delta close to zero is desirable for the option seller; a buyer wants their option to become more valuable whilst a seller wants the option to become less valuable.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks