We’ve seen the H1’2017 has turned out to be one dominated by USD weakness, and the outperformance of EM carry, an outcome expected by few at the beginning of the year.

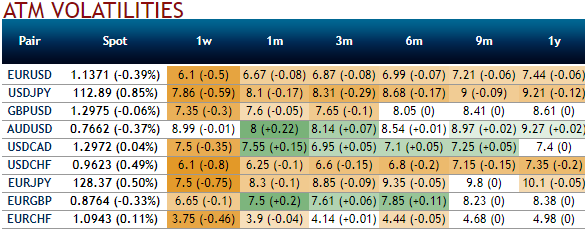

FX vols enter H2 meaningfully cheap versus macro drivers and should mean-revert moderately higher. A U - rather than a V-shaped rebound is consistent with past vol cycles and mixed carry trade positioning. Steep vol curves in G10 should flatten. The complete volatility smile from which one can extract the volatility for any strike.

Please be noted that the current lows suggest multi-month volatility hedges in the FX options OTC markets (refer above nutshell), as in the medium term central bank activity would increase but political risks in G7 has momentarily abated.

With that of EURUSD, EURCHF, and USDCHF, USDCAD volatility remains in the trio of the lowest G10 vols, making options globally inexpensive.

Despite the recent CAD appreciation, the USDCAD realized volatility has remained muted due to the low realized vol environment which makes knock-out barriers attractive.

Such a context does not favor the kind of volatility bursts which could trigger these barriers. Indeed, the USDCAD absolute moves over two months observed on a daily basis since 2013 has been 88% smaller than the current distance between the spot and the KO barrier (690 pips).

Therefore, our barrier setting makes the knock-out event unlikely.

Hence, low realized vol makes KO barriers attractive.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation