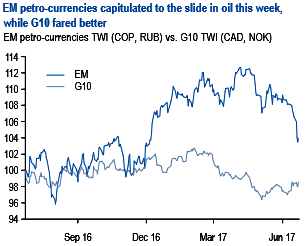

The slide in oil prices has intensified since WTI crude dropped from $52 levels, consequently, oil driven currency crosses seem to be edgy as Brent down another 5% to its 8-month low. The decline in oil prices over the past month had initially primarily impacted only G10 Petro-currencies but the negative momentum finally spilled over into EM Petro currencies this week.

RUB was the primary casualty (-3% vs. USD) followed by COP (refer above chart). The dollar meanwhile has broadly strengthened versus most currencies this week although a surprisingly less dovish stance by certain central banks resulted in some divergence (NZD and NOK outperformed).

The valuation divergence has continued to persist in commodity currencies with NZD and AUD still screening rich vs CAD and NOK. Valuations of Petro-currencies are still near fair value (refer above chart), but still depressed from the long-run point of view.

CAD and NOK appear similarly near fair value but continue to appear quite cheap relative to Antipodeans, where valuations are still rich. NZD is the richer of the two currencies and appears richer-still given the outperformance in the past month.

Both currencies continue to face further downside in this framework as well in our forecasts, especially vs EM high yielders as discussed in prior publications.

These recent cross-currents are also emblematic of the offsetting medium-term forces that keep USDCAD relatively bounded in our quarterly forecasts. The first is revised expected profile of WTI crude prices, after the recent developments from OPEC. We now expect WTI crude prices to firm towards $53/bbl into year-end on the recent OPEC supply agreement, but then for prices to drop notably towards the $39-41/bbl range in 1H’18. Against this, is the expected forthcoming start of BoC policy normalization, for which recently our economists pulled-up the forecasted start to 2Q’18 from 3Q’18. Canadian rates are pressuring the USDCAD again, irrespective of the recent oil turmoil.

Options trades:

Long 08-Dec-17 USDRUB call (59), spot ref: 57.00.

Buy EURUSD vs. EURPLN vol spreads and sell EURNOK – EURSEK correlations, consider medium-term [EURUSD↑, EUR/EM↓] dual digitals.

We’ve already advocated USDCAD trades in our recent write-up, we uphold buying 2m put strike 1.27 KO 1.23 @ 0.17%, vs 0.37% for the vanilla.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise