The FOMC is likely to enact a 3rd hike in the federal funds rate this week. On Wednesday, March 15, the FOMC is likely to hike its funds rate by 25 basis points for the third time during the current economic expansion.

As a result, rotation of CAD shorts from NOK to USD are advised in view of the upgrade in US rate expectations and the lack of momentum in NOK fundamentals at present.

We acknowledge long USDCAD has been a frustrating consensus trade since the US elections but believe there’s a better chance of it working now that CAD positioning is as long as it was short just after the presidential election, while the BoC’s campaign to get investors to differentiate between Canada and the US and to decouple CAD from USD is bearing fruit (see above chart).

Stay short in CADNOK at 6.35 with a strict stop at 6.5725, while simultaneously, encouraging longs in USDCAD at 1.3430 via below option strategy stop at 1.3045.

USDCAD Call Ratio Back Spreads: hedging vehicle to sync with OTC indications

Well, as implied vols are rising amid central bank’s hiking cycle (US Fed) which is highly significant data circumstance for USDCAD, if you ponder vanilla structures are risky ventures, options spreads like positions are more conducive as the underlying spot FX is still hovering around all-time highs. The traders tend to view the call ratio back spread as a bullish strategy because it employs calls.

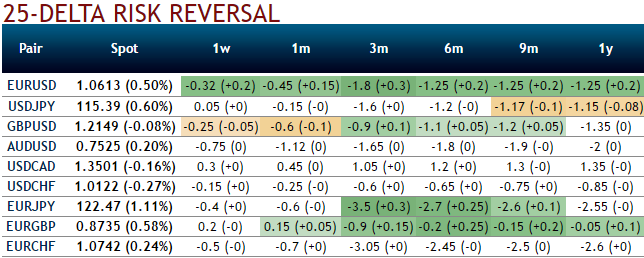

However, it is actually a volatility strategy. Synchronizing both risk reversals and IV skewness of 3m tenors while we uphold longs via ATM calls in below options strategy to hedge the upside risks of this underlying pair.

Hence, we advocate initiating 2 lot of 3m ATM +0.51 delta call, simultaneously, short (1%) OTM call of 1m expiries. One could achieve positive cashflows as the underlying spot keeps spiking.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady