We look ahead for the Riksbank easing monetary policy further at its Thursday meeting, lowering its repo rate by 10bp, to -0.45% vs consensus: 0bp, market pricing: -7bp, given downside risks to inflation.

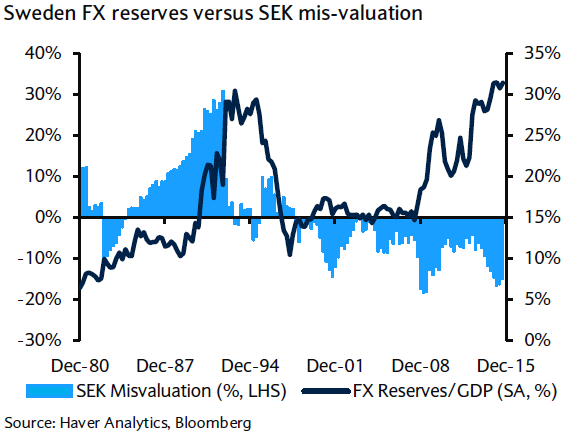

A repo rate cut will likely be preferred over FX intervention, as the SEK remains cheap and FX reserves are already historically large. Foreign exchange reserves in Sweden increased to 493,738 SEK million in January from 493,210 SEK million in December of 2015.

We see some further near-term upside risk to EURSEK but expect rallies to be short lived and maintain our view of SEK outperformance versus the EUR over the next year.

In Norway, the market is forecasting that January underlying inflation (Wednesday) will remain at 3.0% y/y and that headline inflation will increase to 2.5% y/y, from 2.3% in December.

Stay hedged by going long in 2W 9.50-9.35 EUR/SEK credit put spread and short a 2W 9.70 EUR/SEK OTM call.

Only a material recovery in oil prices is likely to stop those cutting rates to new historic lows. While this risk overhangs, we maintain a negative stance on the currency, with EUR/NOK expected to retest the recent highs around 9.60.

We are not surprised even if NOK depreciating to euro to 9.70 by Q1 as vulnerability to the crude oil and there onwards trading modestly lower, may take back to 9.00 by Q4 2016. While, we advocate to stay hedged going long in USD/NOK vs. short USD/CAD 1M gamma spread (calls on USDNOK and puts on USDCAD side).

FxWirePro: Riksbank likely to ease with further 10 bps, expect higher Norwegian inflation – hedge SEK and NOK for depreciation risks

Tuesday, February 9, 2016 7:02 AM UTC

Editor's Picks

- Market Data

Most Popular

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady