We believe the market is complacent of the negative effects on EM FX from protectionism and reflation in core rates. EM FX has recently gained vs. USD as part of broad unwinding of bullish USD positions. However, we expect EM FX weakness to resume in the coming weeks as the reflation theme continues to put upward pressure on core rates. Looming concerns over President Trump’s protectionist trade policies are another negative factor.

This has the potential to introduce some degree of divergence between EM FX performance and G10 performance. While our G10 strategists would see protectionism leading to some gains in safe havens, for instance JPY, for EM FX the implications are almost universally negative. This divergence is currently not fully priced in implied correlations, in our view. Meanwhile, technical factors also remain unsupportive of bullish EM FX positions.

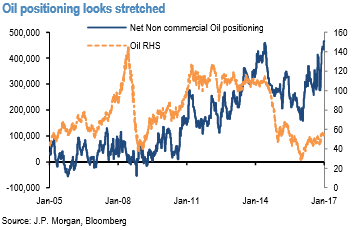

Finally, while commodity prices have been a supportive factor from EM FX so far in 2017, we note that positioning appears stretched (noticeably in oil, refer above chart), which may weigh on commodity currency performance herein.

In outright trades, we hold:

Long USDRUB spot, Long 24-Mar-17 1x1 USDRUB call spread (61.0, 63.5), spot ref: 59.8974.

Long USDPLN, Long 23-Feb-17 EURPLN 1x1 call spread (4.45, 4.60), spot ref: 4.3305.

Short 6m1y USDZAR FVA (30k vega)

Long 23-Feb-17 EURILS 1x1.5 put spread (4.05, 3.90), spot ref: 4.0498.

Short 27-Nov-17 EURCZK forward.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data