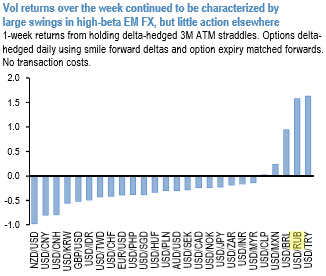

Large gyrations in heavily positioned in high-beta EM FX continued to dominate price action in options markets for another week, but not much of note transpired elsewhere in an otherwise quiet week

RUB implied vols rolled lower following softer-than-expected Q3 GDP and October manufacturing data, CBR governor Elvira Nabiullina is seeking to reign in optimism: she told MPs last week that GDP growth will likely average 1.8% this year; this comes after CBR had upgraded its 2017 forecast to 1.7%-2.2% in September based on strong prior real economy data.

Subsequently, weak Q3 data were published. These numbers are not dramatic – but, they imply at least some downside risk for our 2.1% growth estimate for this year, and increase the likelihood of another 25bp rate cut in December.

Such developments are likely, however, to have only a minor impact on the RUB.

The weakness in Ruble assets accelerated over the recent times. The ruble has weakened by around 4.43% against the US dollar since the mid- October, underperforming other EM currencies (refer above diagram). The underperformance has been driven in part by a less correlation to crude prices.

The currency of the world’s biggest energy exporter is becoming less correlated with crude oil. The RUB suffered its biggest drop since June last month, down 1.5 pct, even as a near 7 pct surge took Brent crude above $60 a barrel for the first time since 2015.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis