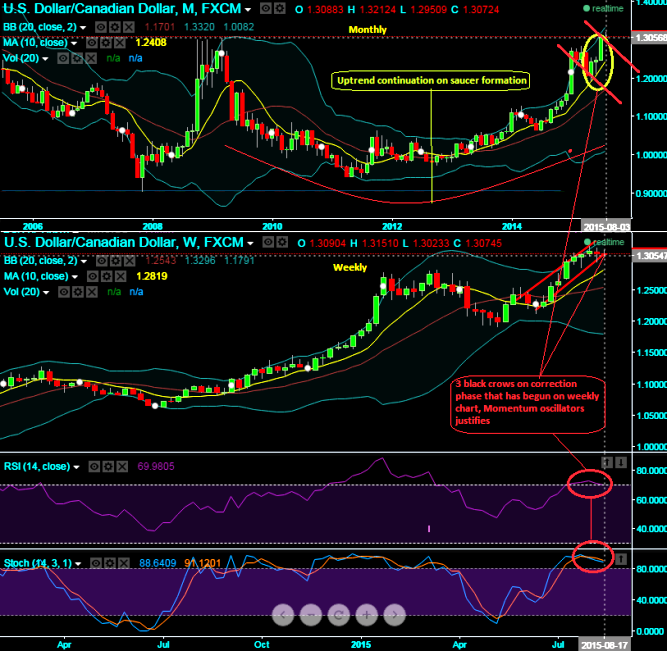

Long term charts evidences the saucer pattern on this pair, a rounding bottom of the prolonged downtrend can used to suggest that the long term trend is reversed. Currently the pair is testing trendline support at 1.3070 levels, if we have to compare the same with monthly plotting then we arrive with 3 black crows in a row which signals short term correction.

Since this pattern has been bullish continuation which we've been observing loony losing and dollar gaining consistently along with crude slumps as well. But for now it is looking to halt and shifting into correction mood.

Generally this pattern will have a powerful move of some 10 to 24 months which we already saw since October 2012, for now the pair is heading towards a market correction mood. The pair will likely sell off into the correction in a downward fashion for maybe 20 to 35% off the old high point. The time factor is generally anywhere from 8 to 12 weeks depending on the overall market condition.

Hence, the overall uptrend in long run remains intact with reasonable corrections on the cards in short to medium term trend.

FxWirePro: Saucer pattern on USD/CAD, retesting trendline support – bull run to resume if 1.3025 sustains

Wednesday, August 19, 2015 12:56 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary