EM Asia FX: We remain UW, albeit with reduced conviction. In this week’s update, we look at how our EM Asia FX sentiment gauges have evolved since the beginning of 2017.This is timely in our view given the generally more positive tone to EM Asia sentiment over this period. Sentiment levels, based off our measure, are at more neutral levels compared with the start of the year. The sentiment gauge is made up of 4 inputs:

1. Spot deviation from its own 200 day moving average;

2. Offshore equity flows (where data is available);

3. The difference between onshore and offshore forward points

4. Implied volatility from the options market.

Each input is standardized as a 3-month rolling Z score and the sentiment gauge is then taken as an unweighted average of these 4 inputs. Higher readings tend to indicate more positive USD sentiment and vice versa for lower readings.

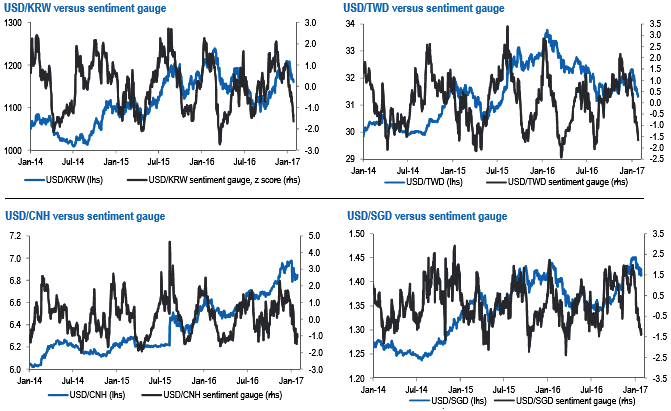

Below we present the sentiment gauge for the major EM Asia currencies. In general, we have seen a greater adjustment in North East Asian currency sentiment gauges, which has been led by KRW and TWD.

The above chart plots USDKRW against the KRW sentiment gauge. After starting the year at around +1 standard deviation, the sentiment has now fallen to -1/-1.5 standard deviations. Part of this obviously reflects the spot move seen in USDKRW but we have also seen positive offshore equity inflows (+USD1.5bn month to date), while implied FX vols have also fallen. As Exhibit 6 highlights though, the sentiment gauge doesn't tend to fall much beyond -2 standard deviations before it stabilizes and turns higher. This is not to say that USDKRW we rebound sharply from the 1160/1170 region but it does suggest something of a cleaner short term position slate compared to the start of the year.

A similar argument can be made for USDTWD and the TWD sentiment gauge (refer above diagram). Taiwan net equity inflows have been slightly stronger (at +USD1.8bn month to date0 and we have also seen a sharp swing in Taiwan offshore NDF points. For an instance the 3-month NDF prints have swung from +10 to -10 over the past month.

The USDCNH and USDSGD sentiment gauges paint a similar picture (refer above diagrams).

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data